Chapter 11: financial application – Casio ClassPad II fx-CP400 Examples User Manual

Page 34

Chapter 11: Financial Application

34

Chapter 11:

Financial Application

The operations in the examples below can be started from any Financial application window.

1101

Compound Interest

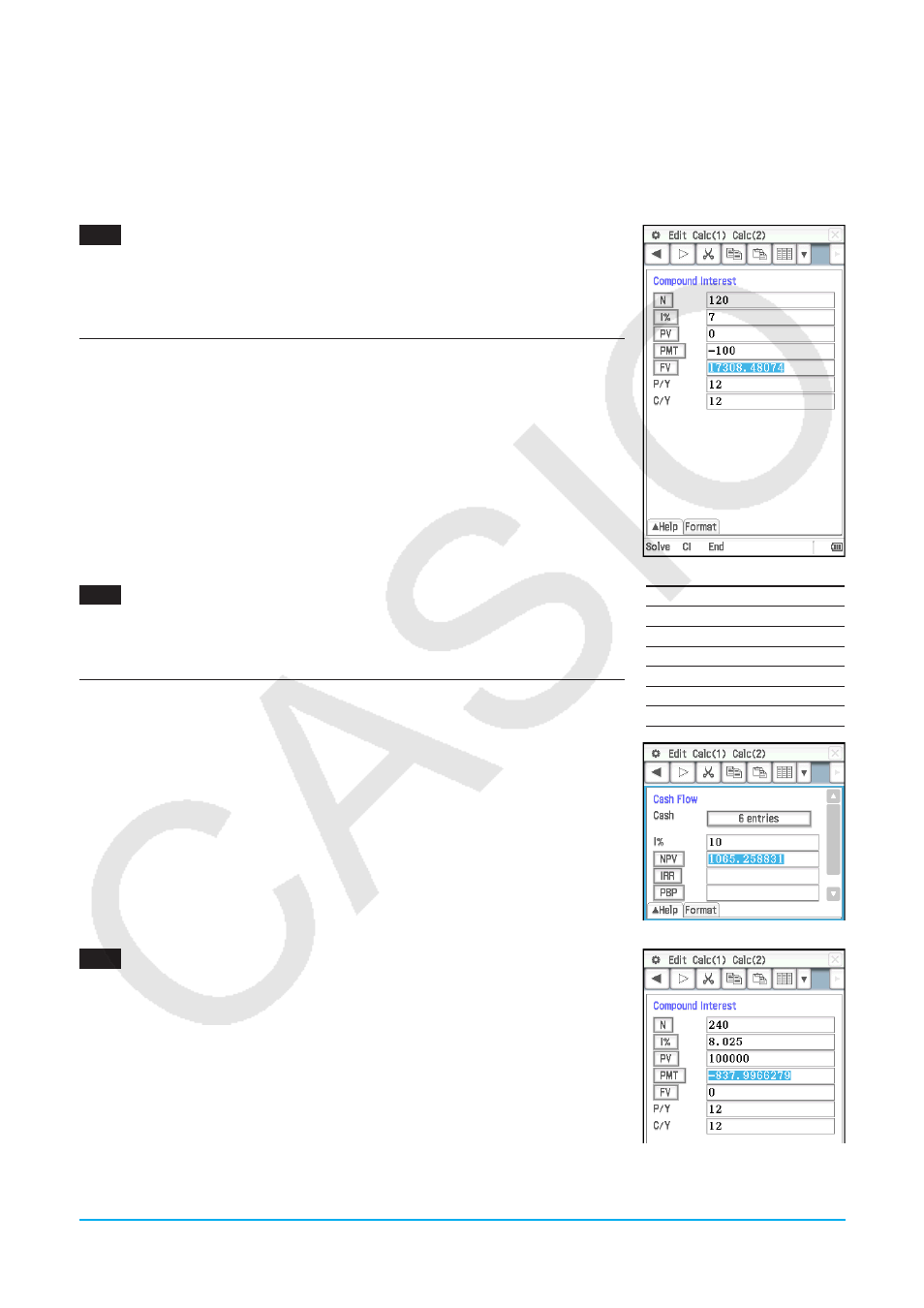

What will be the value of an ordinary annuity at the end of 10 years if $100 is

deposited each month into an account that earns 7% compounded monthly?

Before performing the calculation, change the “Odd Period” setting to

“Compound (CI)” and the “Payment Date” to “End of period”.

1. Tap [Calc(1)] - [Compound Interest].

2. Input the values below into the applicable fields

N = 120 (12 months × 10 years),

I

% = 7, PV = 0,

PMT = –100, P/Y = 12 (month), C/Y = 12 (month)

3. Tap [FV] to obtain the future value.

1102

Cash Flow

How much should you be willing to pay (NPV) for an investment with the cash

flow values shown in the nearby table, if your required rate of return (

I

%) is

10% per year?

Period

Cash Flow

0

0

1

100

2

200

3

300

4

400

5

500

1. Tap ( to open the Stat Editor window in the lower half of the display.

2. Input the cash flow values in cells 1 through 6 under “list1”.

3. Tap the Cash field (which currently shows “

4. On the dialog box that appears, select “list1” for “List variables”, and then tap

[OK].

5. Input 10 into the

I

% field.

6. Tap [NPV] to obtain the net present value.

1103

Amortization

In this example, first use a Compound Interest page to calculate the monthly

payment of a loan, and then use the result to perform Amortization page

calculations. Specify “Compound (CI)” for “Odd Period”, and “End of period” for

“Payment Date”.

Page 1 (Compound Interest): Use a Compound Interest page to determine

the monthly payment ([PMT]) on a 20-year (N = 20 × 12 = 240) mortgage

with a loan amount (PV) of $100,000 at an annual rate (

I

%) of 8.025%,

compounded monthly (C/Y = 12). There are 12 payment periods per year

(P/Y). Be sure to input zero for the future value (FV), which indicates that

the loan will be completely paid off at the end of 20 years (240 months).

Page 1 calculation results

LY777Ex_E.indb 34

13/02/25 11:24