Additional financial functions – HP 12C Financial calculator User Manual

Page 57

57

File name: hp 12c_user's guide_English_HDPMBF12E44

Page: 57 of 209

Printered Date: 2005/7/29

Dimension: 14.8 cm x 21 cm

Section 4

Additional Financial

Functions

Discounted Cash Flow Analysis: NPV and IRR

The hp 12c provides functions for the two most widely-used methods of discounted

cash flow analysis: l (net present value) and L (internal rate of return). These

functions enable you to analyze financial problems involving cash flows (money

paid out or received) occurring at regular intervals. As in compound interest

calculations, the interval between cash flows can be any time period; however, the

amounts of these cash flows need not be equal.

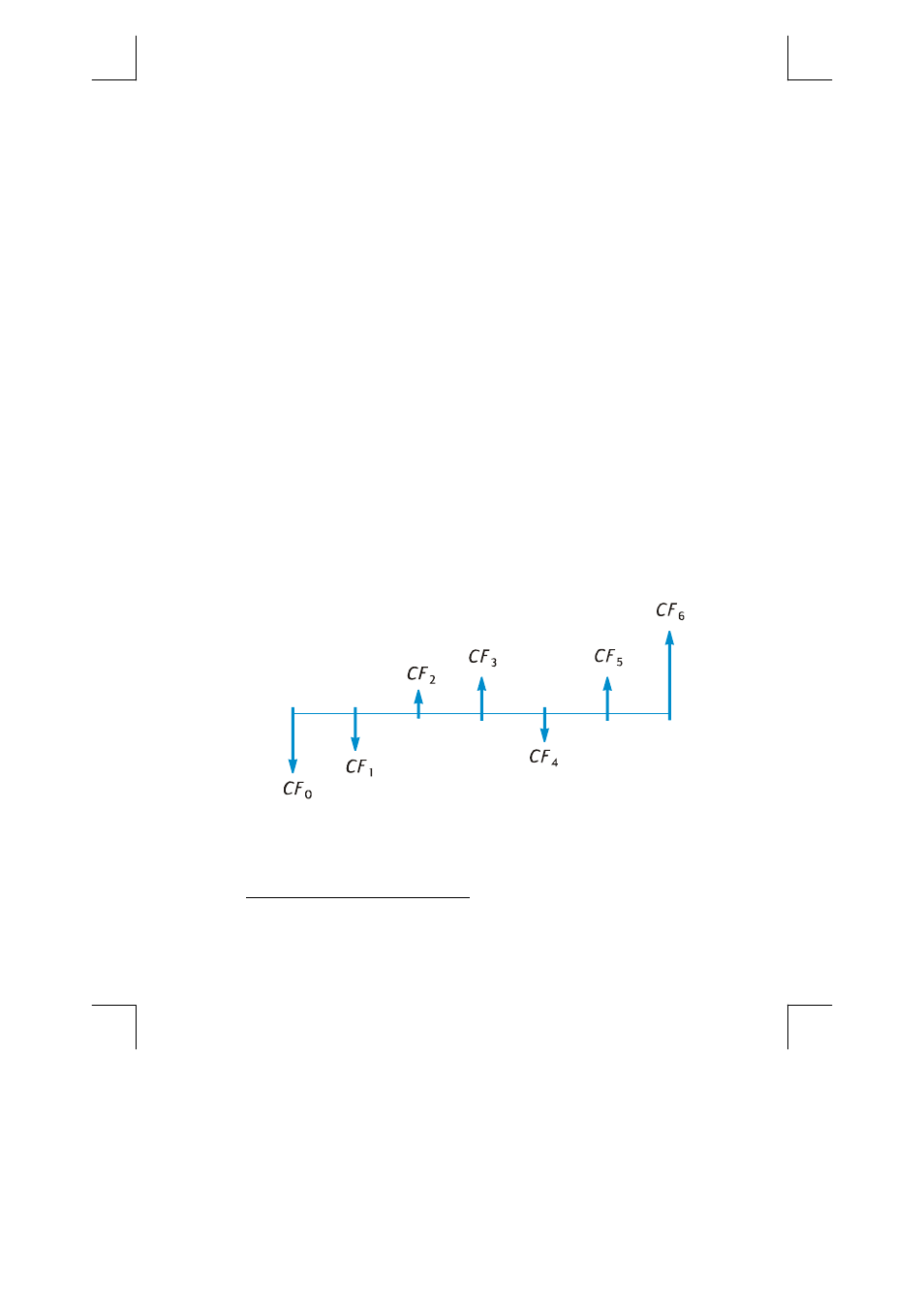

To understand how to use l and L, let’s consider the cash flow diagram for

an investment that requires an initial cash outlay (CF

0

) and generates a cash flow

(CF

1

) at the end of the first year, and so on up to the final cash flow (CF

6

) at the

end of the sixth year. In the following diagram, the initial investment is denoted by

CF

0

, and is depicted as an arrow pointing down from the time line since it is cash

paid out. Cash flows CF

1

and CF

4

also point down from the time line, because they

represent projected cash flow losses.

NPV is calculated by adding the initial investment (represented as a negative cash

flow) to the present value of the anticipated future cash flows. The interest rate, i,

will be referred to in this discussion of NPV and IRR as the rate of return.

*

The

value of NPV indicates the result of the investment:

*

Other terms are sometimes used to refer to the rate of return. These include: required rate of

return, minimally acceptable rate of return, and cost of capital.