HP 12C Financial calculator User Manual

Page 167

Section 16: Bonds 167

File name: hp 12c_user's guide_English_HDPMBF12E44

Page: 167 of 209

Printered Date: 2005/7/29

Dimension: 14.8 cm x 21 cm

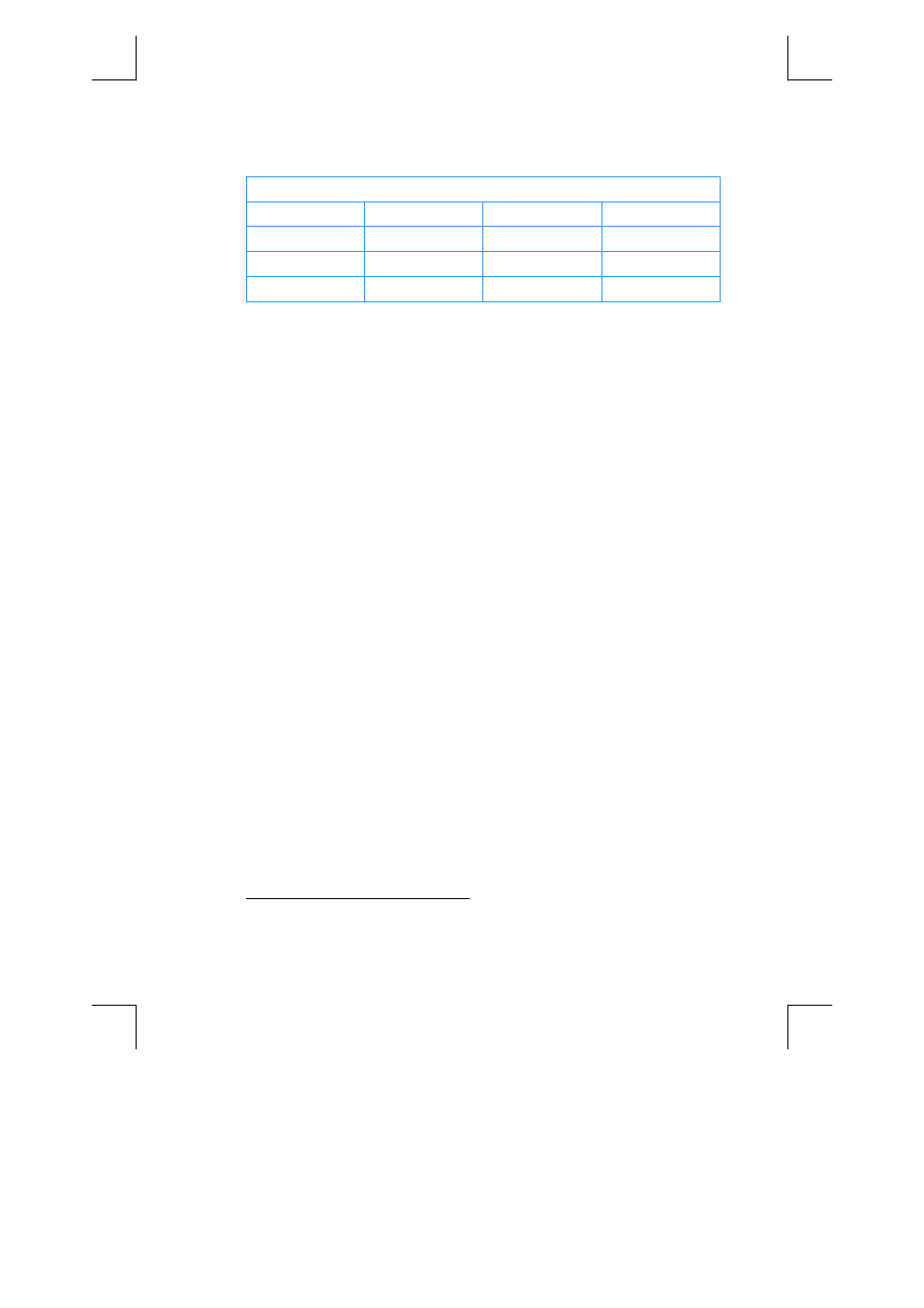

REGISTERS

n: Used

i: Yield

PV: Used

PMT: Cpn. or 0

FV: Used

R

0

: # Periods (n)

R

1

: Yield

R

2

: Coupon

R

3

: Redemption

R

4

: Settlement

R

5

: Next Cpn.

R

6

: Last Coupon

R

7

: Used

R

8

–R

.5

: Unused

For annual coupon bonds calculated on a 30/360 day basis, insert d after

gÒ at steps 19 and 23 (making the program two steps longer).

1. Key in the program and press ?É if the C status indicator is not

displayed.

2. Key in the total number of coupons which are received and press ?0.

3. Key in the annual yield as a percentage then press ?1.

4. Key in the amount of the annual coupon then press ?2.

*

5. Key in the redemption value then press ?3.

*

6. Key in the settlement (purchase) date

†

then press ?4.

7. Key in the date of the next coupon then press ?5.

8. Press t to obtain the amount of accrued interest.

9. Press t to determine the priceof the bond.

10. For a new case, return to step 2.

Example: What is the price and accrued interest of a 20-year Eurobond with

annual coupons of 6.5% purchased on August 15, 2004 to yield 7%. The next

coupon is received on December 1, 2004.

Keystrokes Display

?Æ

Set compound interest mode if the C

indicator is not on.

20?0

20.00

Total number of coupons.

7?1

7.00

Annual yield.

6.5?2

6.50

Annual coupon rate.

100?3

100.00

Redemption value.

8.152004?4

8.15

Settlement date.

12.012004?5

12.01

Next coupon date.

t

–4.58

Accrued interest.

t

–94.75

Purchase price.

*

Positive for cash received; negative for cash paid out.

†

For information about date format see pages 29 to 30.