HP 12C Financial calculator User Manual

Page 135

Section 12: Real Estate and Lending 135

File name: hp 12c_user's guide_English_HDPMBF12E44

Page: 135 of 209

Printered Date: 2005/7/29

Dimension: 14.8 cm x 21 cm

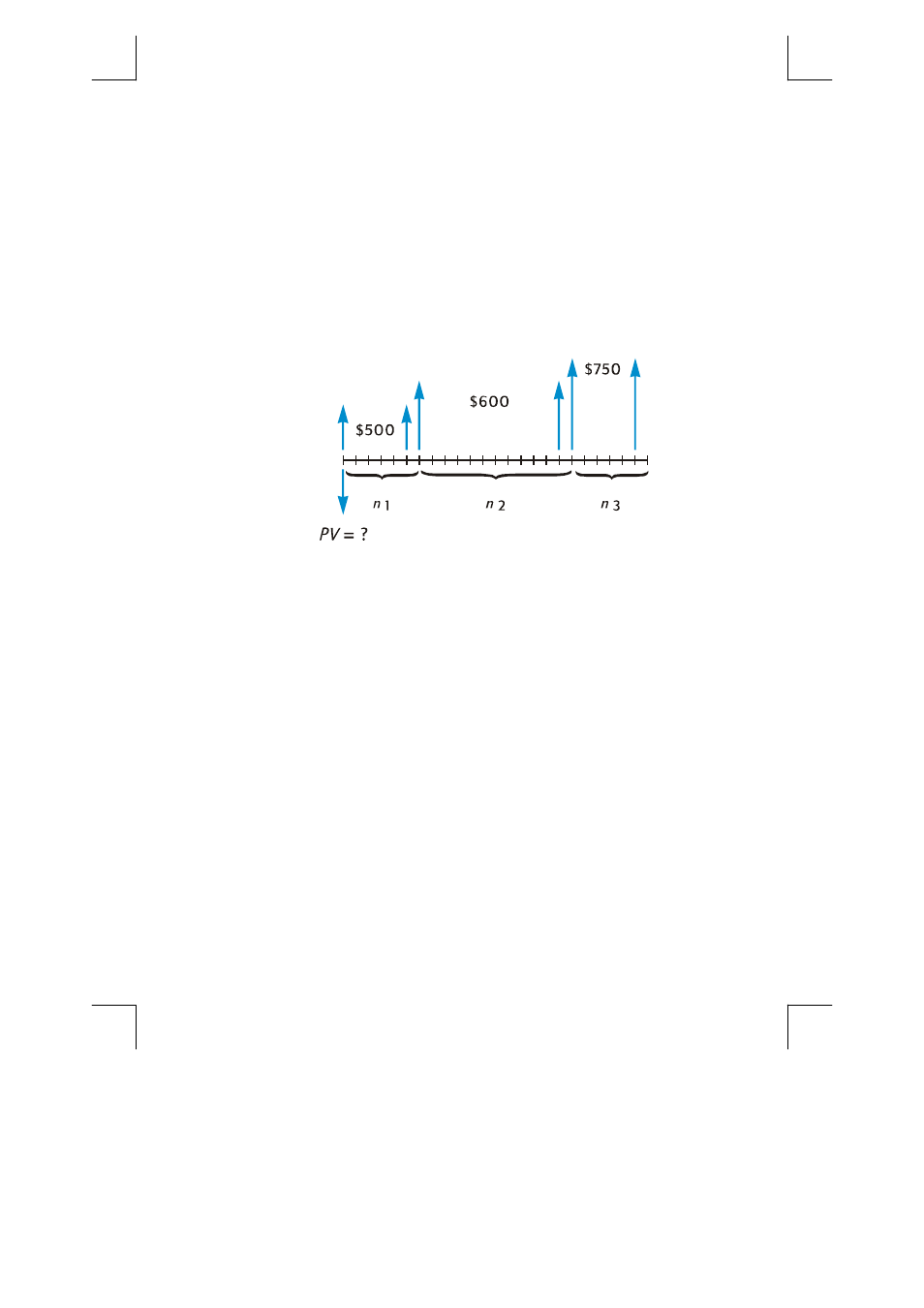

Leases often call for periodic contractual adjustments of rental payments. For

example, a 2-year lease calls for monthly payments (at the beginning of the month)

of $500 per month for the first 6 months, $600 per month for the next 12 months,

and $750 per month for the last 6 months. This situation illustrates what is called a

“step-up” lease. A “step-down” lease is similar, except that rental payments are

decreased periodically according to the lease contract. Lease payments are made

at the beginning of the period.

In the example cited, the rental payment stream for months 7 through 24 are

“deferred annuities,” as they start at some time in the future. The cash flow

diagram from the investor’s viewpoint looks like this:

To find today’s present value of the cash flows assuming a desired yield, the NPV

technique may be used. (Refer to pages 58 thru 62.)

Example 2: A 2-year lease calls for monthly payments (at the beginning of the

month) of $500 per month for the first 6 months, $600 per month for the next 12

months, and $750 per month for the last 6 months. If you wish to earn 13.5%

annually on these cash flows, how much should you invest (what is the present

value of the lease)?

Keystrokes

Display

fCLEARH

0.00

Initialize.

500gJ

500.00

First cash flow.

gK

5ga

500.00

5.00

Second thru sixth cash flows.

600gK

12ga

600.00

12.00

Next twelve cash flows.

750gK

6ga

750.00

6.00

Last six cash flows.

13.5gC

1.13

Monthly interest rate.

fl

12,831.75

Amount to invest to achieve a

13.5% yield.