EdgeWare FastBreak Pro Version 5 User Manual

Page 78

78

Since 0.86 is greater than 0.85, no robustness adjustment is made to the original 24%

performance.

Which method, Average or Lowest, is better? Our research shows both give similar

results, but we have a slight preference for the Lowest option.

We have experimented with different values for the Robust Factor, and we prefer 10%

for the robustness factor. We have experimented with the Maximize Robustness value,

and we prefer 0.85. Please feel free to experiment and determine your own value

preference.

There is a severe penalty in run time when using the Maximize Robustness option. It

takes three times longer to run the same number of generations. However, in general, we

have seen improved out-of-sample results. We encourage you to experiment. Here are

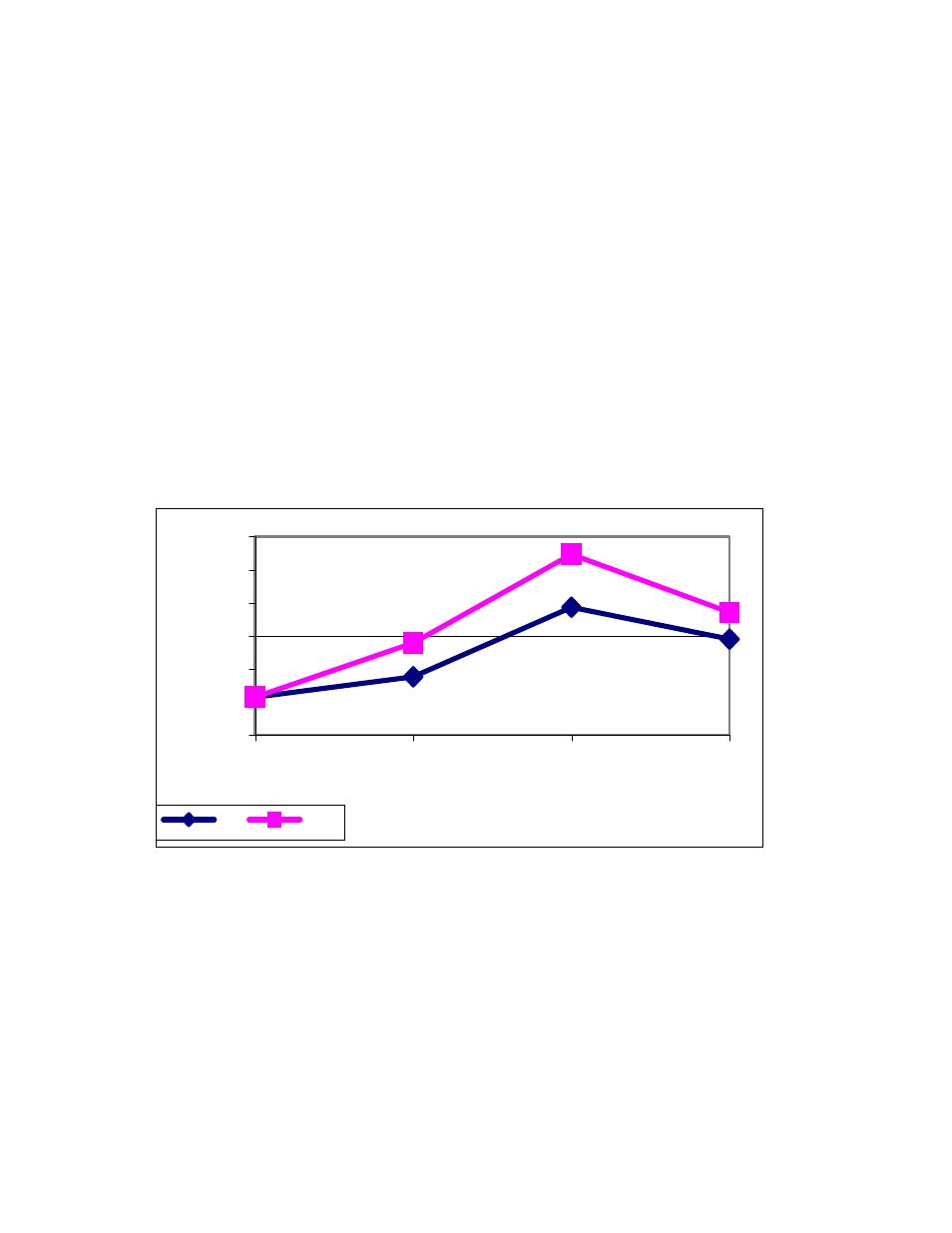

the results of four optimization runs where the only variable changed is the +/- values

used to determine robustness:

By doing a variation of +/- 10% in our robustness check, we obtained the best OS

performance. Smaller and larger values did not provide results that were as good.

Note: If you elect not to use the Maximize Robustness option, you will notice that

FastBreak calculates the robustness value when a strategy makes it into the Top 10 of

the Best Results screen. This is to provide additional information to help select which

of the top ten systems to use.

Using the robustness option does not always result in trading systems with the best IS

and OS trading systems. Actually, the above chart is somewhat unusual in that the IS

results actually improved with the use of the robustness check. Typically, better returns

24

26

28

30

32

34

36

0

5

10

15

Variable Variation, +/-%

Return, %/year

IS

OS