EdgeWare FastBreak Pro Version 5 User Manual

Page 33

33

described in the Appendix. Note: Activation of the Maximize Robustness option will

triple run time; however, we believe it is critical to building good trading systems. If

robustness is not activated, the optimized trading systems are very susceptible to over-

optimization.

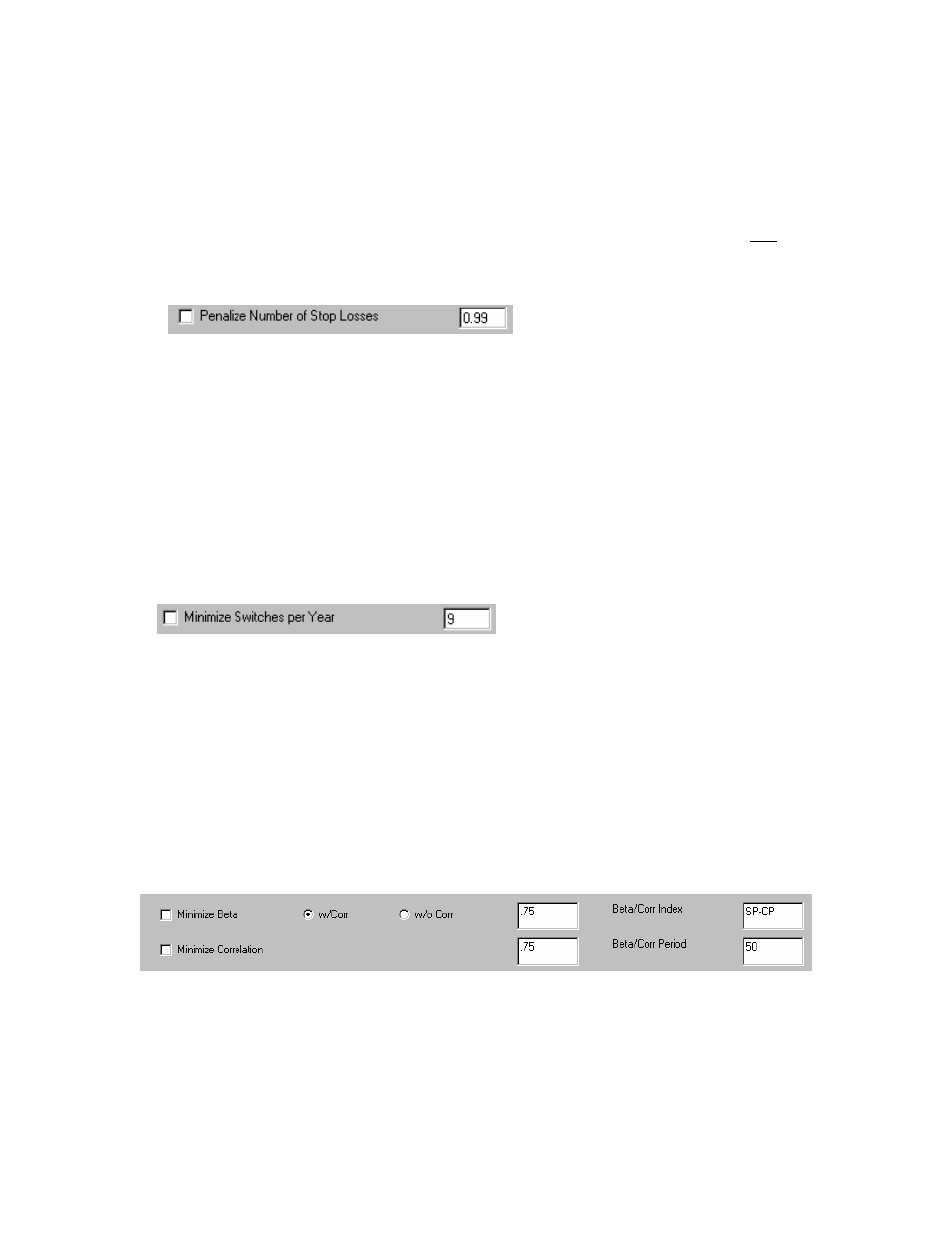

We have found that, under some circumstances, strategies with more stop loss and buy

filters options activated can lead to non-robust strategies. We have added a penalty

function:

The user-defined penalty value is raised to a power (exponent) that is equal to the number

of stops used. A recommended penalty value is 0.99 For example, if a single stop is

used, a strategy adjusted performance will be reduced by multiplying by the penalty (0.99

in the default). If two stops are used, the penalty is (0.99 x 0.99). This will push toward

using fewer stop and buy filter options. If you find that FastBreak continues to select

strategies with too many stop functions activated, then try changing the penalty to smaller

values, i.e., 0.98, 0.97 etc., and this will reduce the number of options used. We

recommend that this option always be activated.

You can also drive toward strategies that have a user-defined maximum number of

switches:

Check the Minimize Switches per Year box and input the maximum acceptable number.

Strategies that have greater than the user defined number of switches will have a penalty

added such that these strategies will not tend to “survive.” The penalty is simply the

desired number of switches per year divided by the strategy historical number of switches

per year. This option will force strategies to evolve toward the number of switches

desired. This can be a very useful function because many mutual fund companies

discourage excessive trading.

If the user desires strategies that have a maximum beta or maximum correlation, then use

the following options:

For example, if the user wants the strategy to have a maximum beta of 0.75 (as measured

against the S&P 500 Index) over any 50 day period of the trading strategy, then the above

option would be used. The maximum beta value acceptable needs to be input, as well as

the index and period for the beta calculation. The S&P 500 is the most common index

for measuring beta, and is the default index, but any index or fund in the FastTrack