EdgeWare FastBreak Pro Version 5 User Manual

Page 59

59

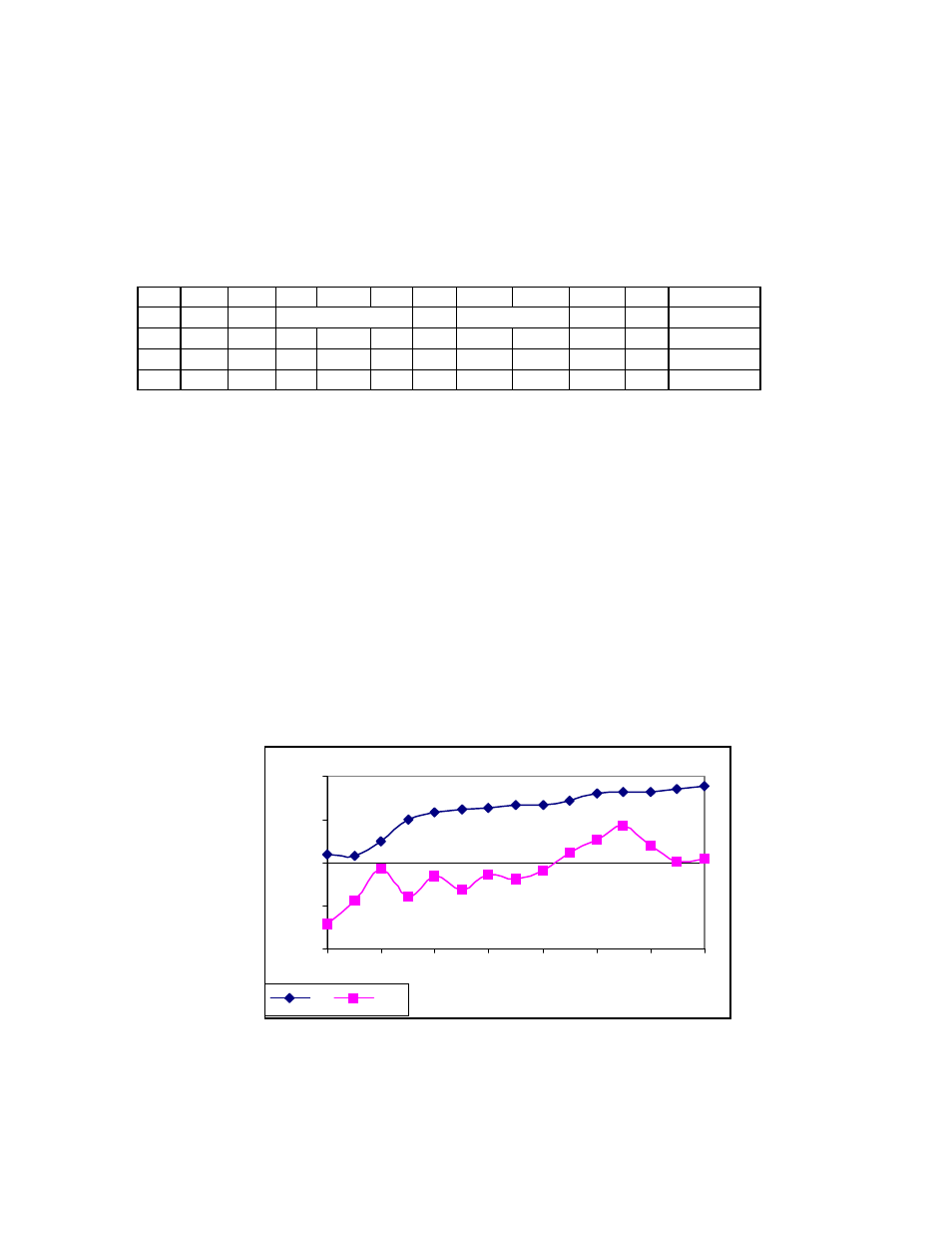

Keeping Track of Optimization Runs

It is useful to keep a simple record of optimization runs. Although it is a simple matter to

reload the restart file or optimization parameters file to check parameter choices and

ranges, we find it useful to keep a simple spreadsheet record of runs. The spreadsheet

can be filled out in less than a minute when an optimization run completes. Here is an

example of the format we use for keeping records:

IS

OS

1/4/93 to 10/1/96

10/1/96 to 4/1/98

Case Gens Funds Best IS

OS UPI MDD

S/Y

Max

Min Notes

Exp1 6

3

2

21.4

30.3

3.24

22.24

34.7

52.97

6.26 5%

Mutation

2 15 3 8

24.2 34.9

3.29

22.54

36.3

46.98

9.7 10%

Mutation

Note: The following studies were made with earlier versions of FastBreak Pro. You

may get somewhat different results if you recreate the studies, but we wanted to share

with you some of the issues we studied.

Over-optimization

The trading system developer should always be wary of over-optimization. The GA

optimizer will continue to look for better combinations of parameters that give

increasingly better results in the In-Sample (IS) time period. This is certainly important

because we know that a system that performs poorly in the past is unlikely to perform

well in the future. When we begin to see that the evolved systems do not have good

predictive power, it is time to stop optimization. Here is a chart from an optimization run

that holds three Fidelity Select funds:

The IS average return has a smooth increase as the GA finds better parameters each

generation. The OS return is less smooth, but we see that at in the 12

th

generation a peak

appears. This is not to say that if we allow the GA to continue it will not find a better

15

20

25

30

35

1

3

5

7

9

11

13

15

Generation

OS Return, %/year

IS

OS