Kase dev-stop – EdgeWare FastBreak Standard Version 5 User Manual

Page 85

85

When using the parabolic stop, FastBreak will not purchase a fund if it is trading below

its parabolic because the fund would be stopped out the following day.

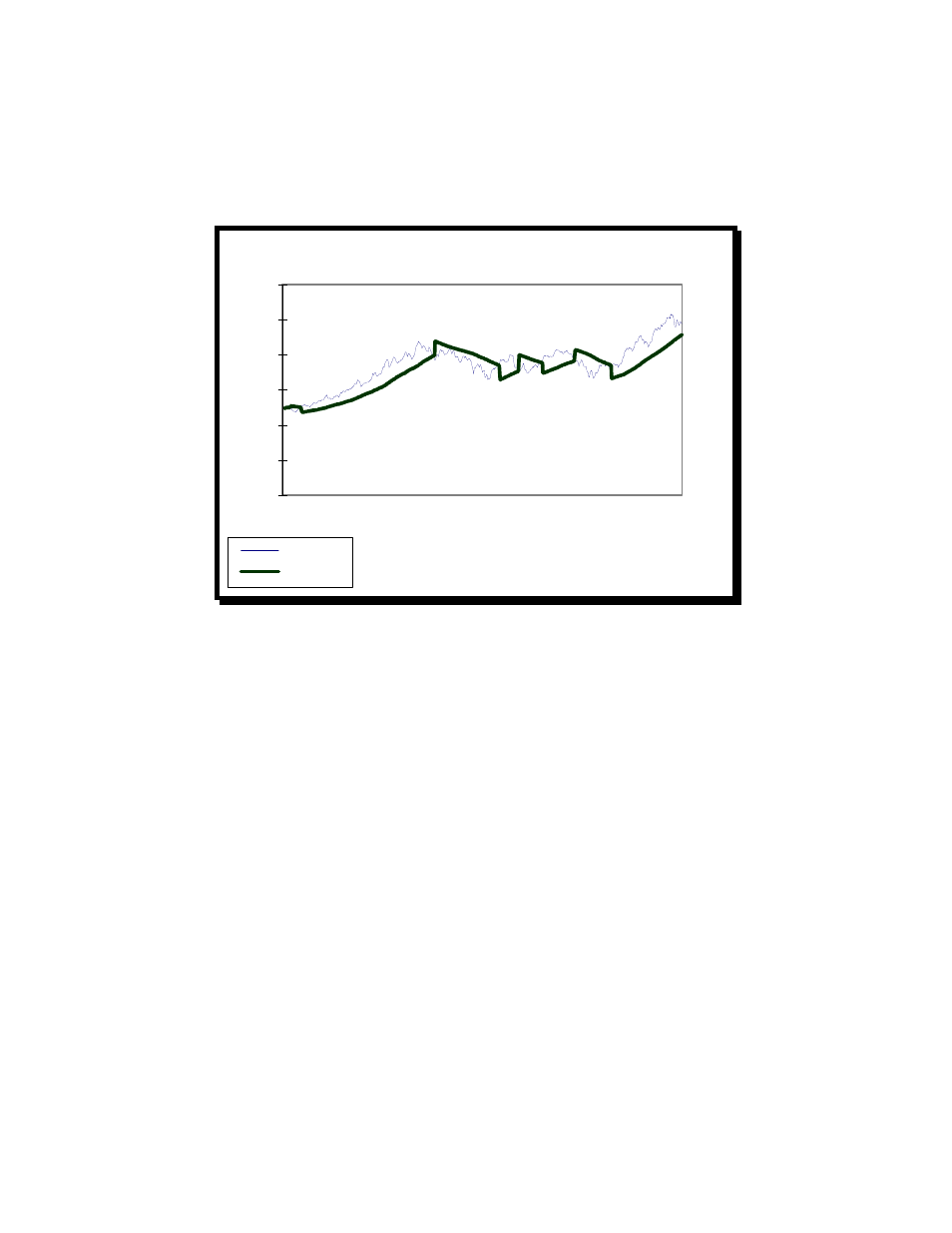

Graphically, the mutual fund NAV and corresponding parabolic value look as follows:

Parabolic

0

10

20

30

40

50

60

0

100

200

300

400

500

Trading Days

NAV, $

NAV

Parabolic

Kase Dev-Stop

The Dev-Stop system was developed by Cynthia Kase and is explained in her book Trad-

ing with the Odds. The Dev-Stop can be used to trade both long and short positions.

FastBreak uses the system only to generate sell signals. The advantage to the Dev-Stop

is that the stop point is adjusted for the volatility of the fund. More volatile funds have

wider stops than less volatile funds. The fund is sold when the NAV drops below the

Dev-Stop value. The Dev-Stop formula can be summarized as follows:

Dev-Stop = Trade_high - ATR - #SD x SD

Where:

Dev-Stop = Dev-Stop value

Trade_high = NAV high since the trade began

ATR = Average True Range

#SD = Number of standard deviations on true range

SD = Standard deviation of the true ranges

The ATR is the average of the daily true ranges. Since mutual funds do not have a daily

range (only closing prices) as stocks do, FastBreak calculates a synthetic true range by