EdgeWare FastBreak Standard Version 5 User Manual

Page 35

35

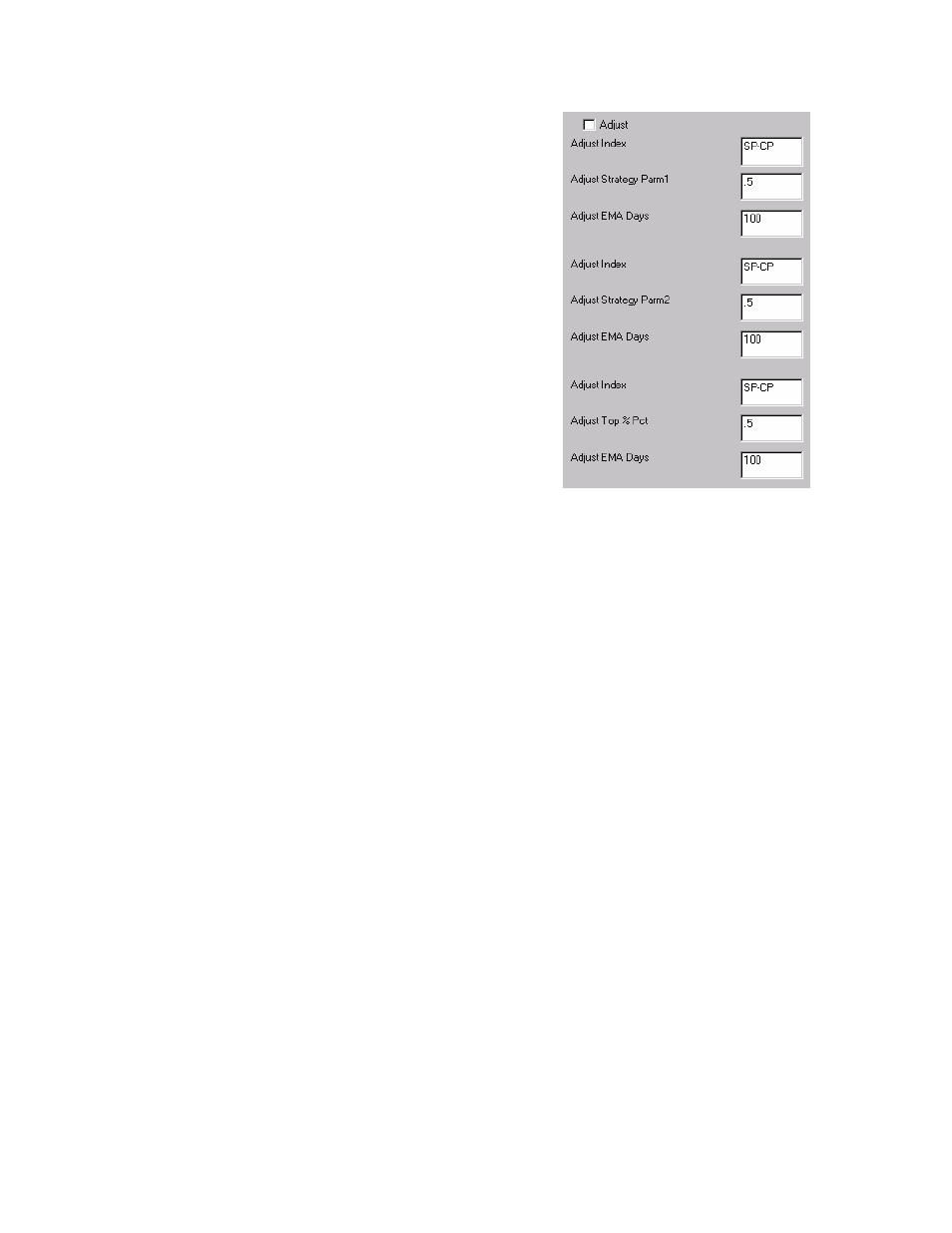

Dynamic Adjustment of Ranking Periods and Top%

This option allows adjusting some parameters as market conditions change. For exam-

ple, you may propose that ranking parameters should be longer when the general market

is trending up, and shorter parameters used when the market is moving sideways or mov-

ing down. The way the option works is to apply the Adjust Factor when the Adjust Index

breaks (moves lower) than its Exponential Moving Average (EMA) specified by the Ad-

just EMA Days.

Use the S&P 500 Index as an example for the Adjust Index and 0.5 as the Adjust Buy

Pct. Suppose you are using a ranking parameter of 30 days for Buying. FastBreak will

use those parameters as long as the S&P 500 Index is above the EMA that you specified

(100 days in the above example); however, if the Index moves lower than the 100 EMA

or the S&P 500 Index, then the 0.5 factor will be applied to the Buying ranking period,

i.e., Buying ranking period will become 15. Note: The Detail tab and file will not reflect

this change. When the Index moves above the EMA, the ranking parameters will change

back to the specified long values. Adjustments can be applied to the ranking strategy

first parameter, the ranking strategy second parameter, and the Top% value. Adjustment

factors can be greater than 1.0 This will result in increasing the ranking parameters and

Top% when the specified index falls below the specified EMA. Note: We use the term

Strategy Parm1 and Strategy Parm2 to reference the parameters in the momentum

strategy. For example, with simple ranking this will be the number of days used in buy

and sell ranking. However, for strategies like GAM, Parm1 will refer to the buy and

sell period and Parm2 refers to the EMA value. We recommend you only use the Ad-

justment option with simple buy and sell momentum strategies, i.e., simple rank, UPI,

Sharpe Ratio, and slope ranking. The use of this option with AccuTrack ranking will

produce meaningless results.