EdgeWare FastBreak Standard Version 5 User Manual

Page 30

30

EMA describe the range of Exponential Moving Average Periods used to smooth the cur-

rent price.

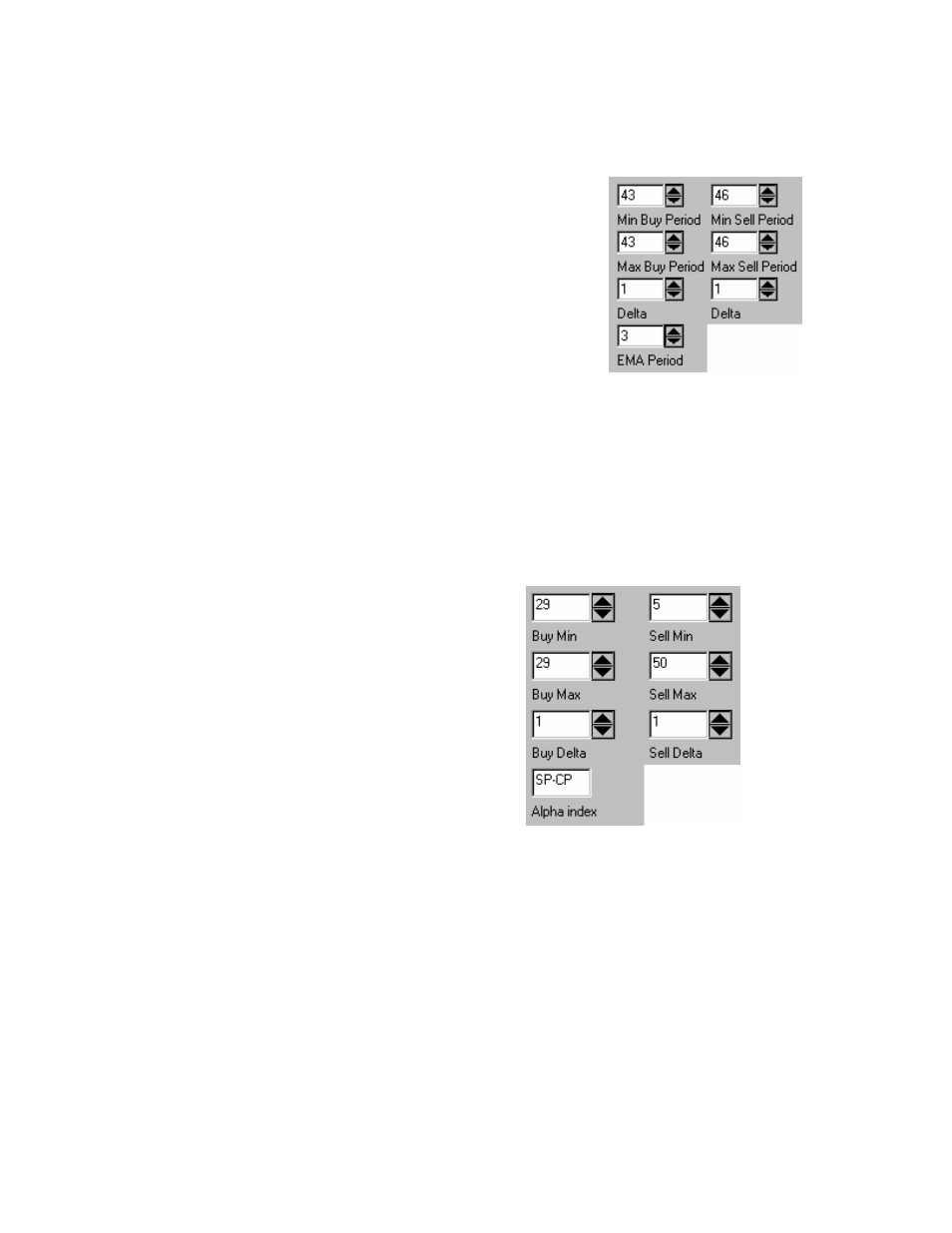

Min Buy Period, Max Buy Period, Delta, and EMA Period

Min Sell Period, Max Sell Period, Delta

Note: These parameters are only visible if Buy and Sell using Most Anchored Momen-

tum has been selected. See Appendix A for a complete discussion of this strategy. Min

and Max Buy Period describe the range of look-back periods to test for buying a fund.

Delta is the size of the increment to use in the testing range. Min and Max Sell Period

describe the range of the look-back period to test for selling a fund. Delta is the size of

the increment to use in the testing range. EMA Period is the Exponential Moving Aver-

age to use to smooth the most current price.

Buy Min, Buy Max, Buy Delta, Alpha index

Sell Min, Sell Max, Sell Delta

Note: These parameters are only visible if Buy and Sell using Alpha has been selected.

See Appendix A for a complete discussion of this strategy. Min and Max Buy Period de-

scribe the range of look-back periods to calculate alpha for buying a fund. Delta is the

size of the increment to use in the testing range. Min and Max Sell Period describe the

range of the look-back period to calculate alpha for selling a fund. Delta is the size of the

increment to use in the testing range. Alpha index is the index to use to calculate alpha.

The default is the S&P 500 index (SP-CP in FastTrack); however, any index, fund, stock

or FNU file can be used. Note: You must select an index that is available from the Start

Date plus going back additional days to account for the maximum ranking period you

expect to test.