HP 10B User Manual

Page 51

Attention! The text in this document has been recognized automatically. To view the original document, you can use the "Original mode".

m

шш

ш

Ш]

(ЁУ)

Number of periods or payments.

Annual percentage interest rate (usually the annual nomi

nal rate).

Present value (the cash flow at the beginning of the time

line).

Periodic payment.

Future value (the cash flow at the end of the cash flow

diagram, in addition to any regular periodic payment).

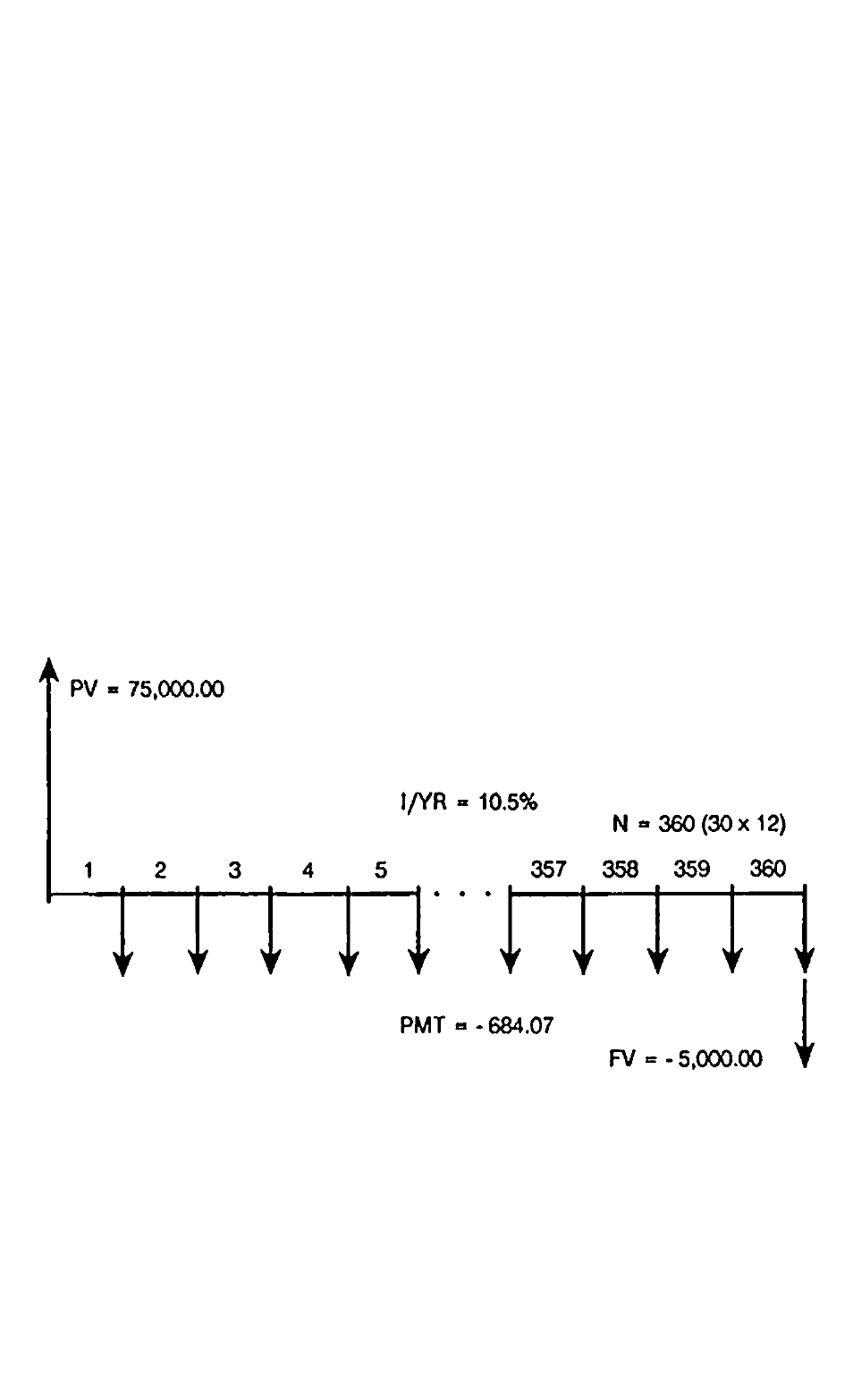

You can calculate any value after entering the other four. Cash flow

diagrams for loans, mortgages, leases, savings accounts, or any contract

with regular cash flows of the same amount arc normally treated as TVM

problems. For example, following is a cash flow diagram, from the

borrower’s perspective, for a 30-ycar, $75,000.00 mortgage, with a pay

ment of $-684.07, at 10.5% annual interest, with a $5,000 balloon pay

ment.

One of the values for

PV^

PA/T,

FV

can be zero. For example, following is

a cash flow diagram (from the saver’s perspective) for a savings account

with a single deposit and a single withdrawal five years later. Interest

compounds monthly. In this example, PA/r is zero.

4в 4: Picturing Financial Problems