Computation of vat (value added tax)/tax, Vat/tax system – Sharp UP-3300 User Manual

Page 62

59

Computation of VAT (Value Added Tax)/Tax

■

VAT/tax system

The POS terminal may be programmed for the following six tax systems by your authorized SHARP dealer.

Automatic VAT 1 through 6 system (Automatic operation method using programmed percentages)

This system, at settlement, calculates VAT for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and

taxable 6 subtotals by using the corresponding programmed percentages.

Automatic tax 1 through 6 system (Automatic operation method using programmed percentages)

This system, at settlement, calculates taxes for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and

taxable 6 subtotals by using the corresponding programmed percentages, and also adds the calculated

taxes to those subtotals, respectively.

Manual VAT 1 through 6 system (Manual entry method using programmed percentages)

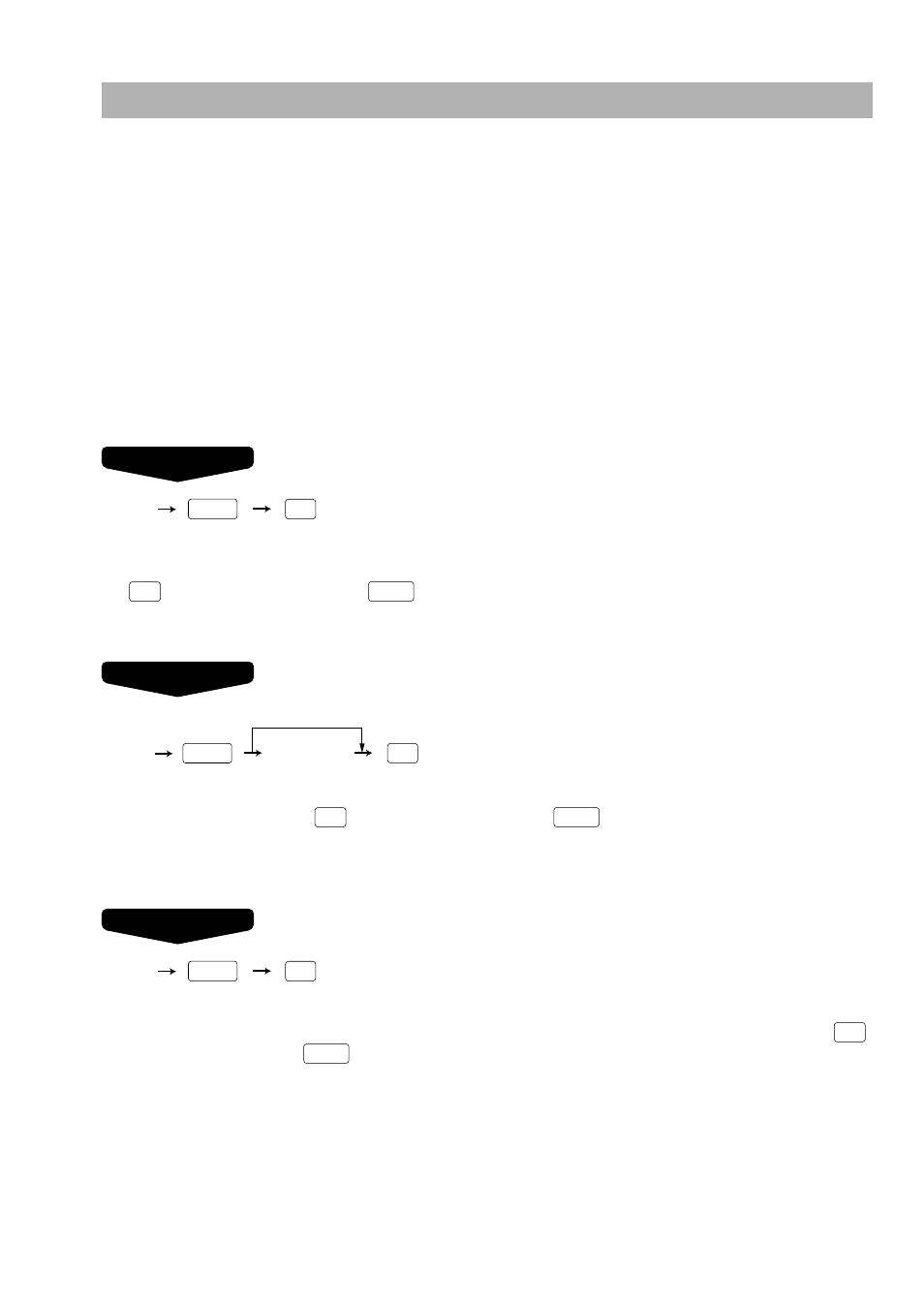

Procedure

SUB TOTAL

VAT

This system provides the VAT calculation for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and

taxable 6 subtotals. This calculation is performed using the corresponding programmed percentages when

the

VAT

key is touched just after the

SUB TOTAL

key.

Manual VAT 1 system (Manual entry method for subtotals that uses VAT 1 preset percentages)

Procedure

VAT rate

To use a programmed rate

SUB TOTAL

VAT

This system enables the VAT calculation for the then subtotal. This calculation is performed using the VAT 1

preset percentages when the

VAT

key is touched just after the

SUB TOTAL

key. For this system, the keyed-in tax

rate can be used.

Manual tax 1 through 6 system (Manual entry method using programmed percentages)

Procedure

SUB TOTAL

VAT

This system provides the tax calculation for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and taxable

6 subtotals. This calculation is performed using the corresponding programmed percentages when the

VAT

key is touched just after the

SUB TOTAL

key. After this calculation, you must finalize the transaction.

Automatic VAT 1 through 3 and tax 4 through 6 system

This system enables the calculation in the combination with automatic VAT 1 through 3 and tax 4 through 6.

This combination can be any of VAT 1 through 3 and tax 4 through 6. The tax amount is calculated

automatically with the percentages previously programmed for these taxes.