Euro programming, Secret code programming, Rounding programming (for australian tax system) – Sharp XE-A102B User Manual

Page 24

22

Advanced Programming

For the details of EURO programming, please refer to “EURO Migration Function” on pages 16 and

17.

3

➜

S

➜ ABCDEFGH ➜

S

(

➜

S

)

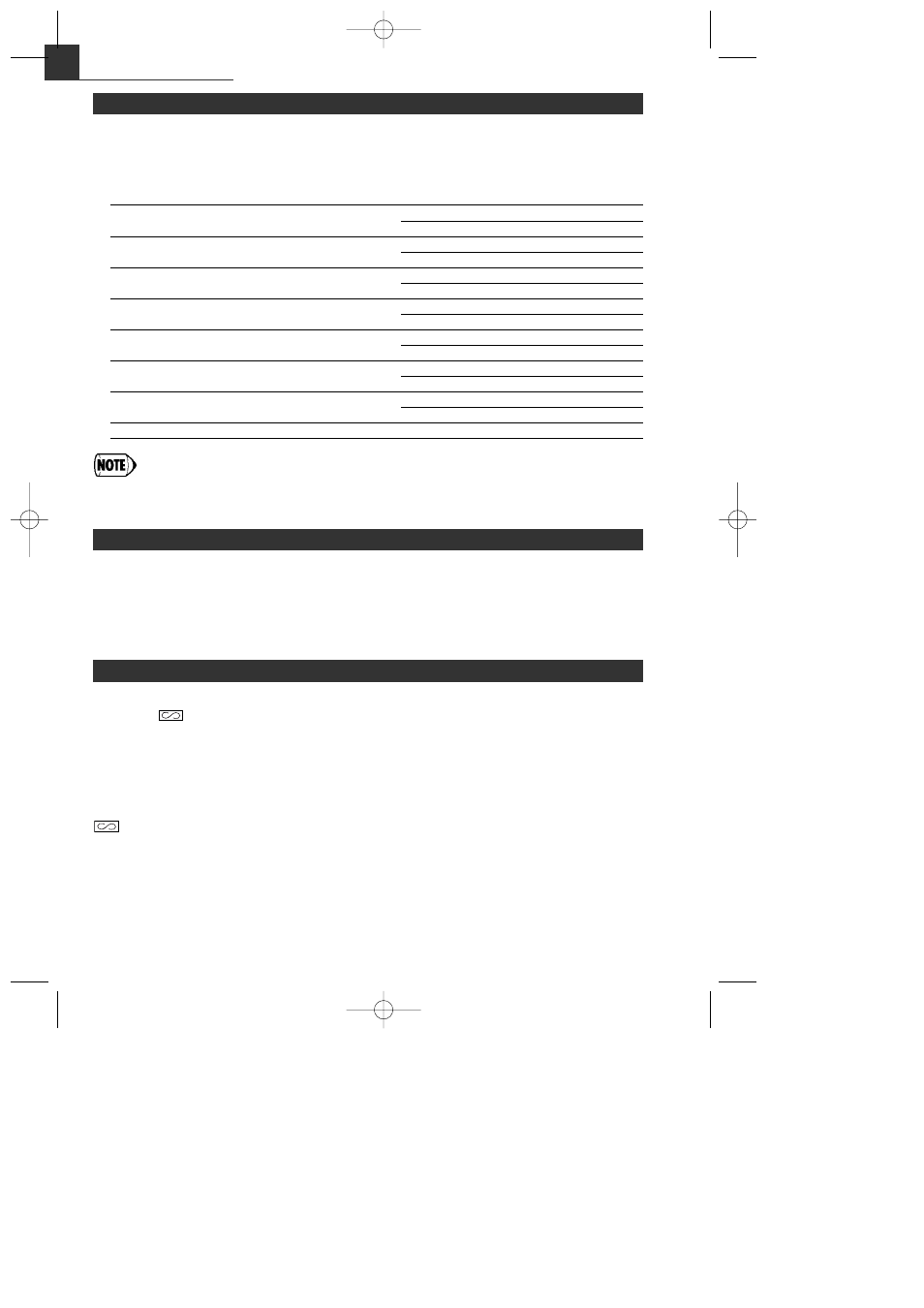

Parameters:

Selection:

Entry:

A

Automatic conversion of unit prices of Depts.

No*

0

/PLUs by automatic EURO migration operation

Yes

1

B

Conversion rate printing

No*

0

Yes

1

C

Exchange amount printing for

No*

0

total & change

Yes

1

D

Cheque & credit operation when

No*

0

tendering in foreign currency

Yes

1

E

Exchange calculation method

Multiplication*

0

Division

1

F

Rounding for exchange

Rounding up*

0

Rounding

1

G

Currency symbol for foreign currency

Space*

0

EURO

1

H

Decimal point position for foreign currency

0 through 3 (Default: 2)

If you select “Yes” for exchange amount printing for total and change, you can display a

change in foreign currency by pressing

E when the change is displayed in domestic

currency.

EURO Programming

A secret code is used in order to allow only those who know the secret code to operate the

machine in

and Z/PGM modes or to print Z reports. When you need a secret code, program

a secret code.

Secret code (max. 4 digits)

➜

x

➜

t

(

➜

S

)

(Default: 0000; no application of secret code)

How to enter a secret code:

In case that a secret code has been programmed, “----” is displayed when the mode switch is set to

or Z/PGM or when you need to issue a Z report. In this case, enter the secret code (max. 4

digits) and press

t. Every time you enter a digit, the display of “-” changes to “_”.

In case you forget the secret code you programmed:

Set the mode switch to the Z/PGM position, and operate the secret code programming shown

above with the substitution of “0000” for the secret code.

Secret Code Programming

When Australian rounding is set, the sales total amount is rounded to 0 or 5 when paid in cash.

4

➜

S

➜

0

for No or

1

for Yes

➜

S

(

➜

S

)

(Default: Yes for the register shipped to Australia)

Rounding Programming (For Australian tax system)

A102_01(E) 05.4.18 9:06 AM Page 22