Food stamp tendering, Food stamp calculations – Sony ER-A420 User Manual

Page 42

40

Food stamp tendering

If your customer makes payment (or tendering) in food stamps, obtain the food stamp-eligible subtotal* by

pressing the

f

key and make a food stamp tender entry before entering a cash or check tender.

The food stamp-eligible subtotal* depends upon how your register is programmed based on the

food stamp-eligibility of the automatic tax on a sale of items eligible for food stamp payment, or

whether your register is programmed to allow the automatic tax to be paid with food stamps or not

or to exempt taxation. The example below presupposes that your register has been programmed

to exempt taxation.

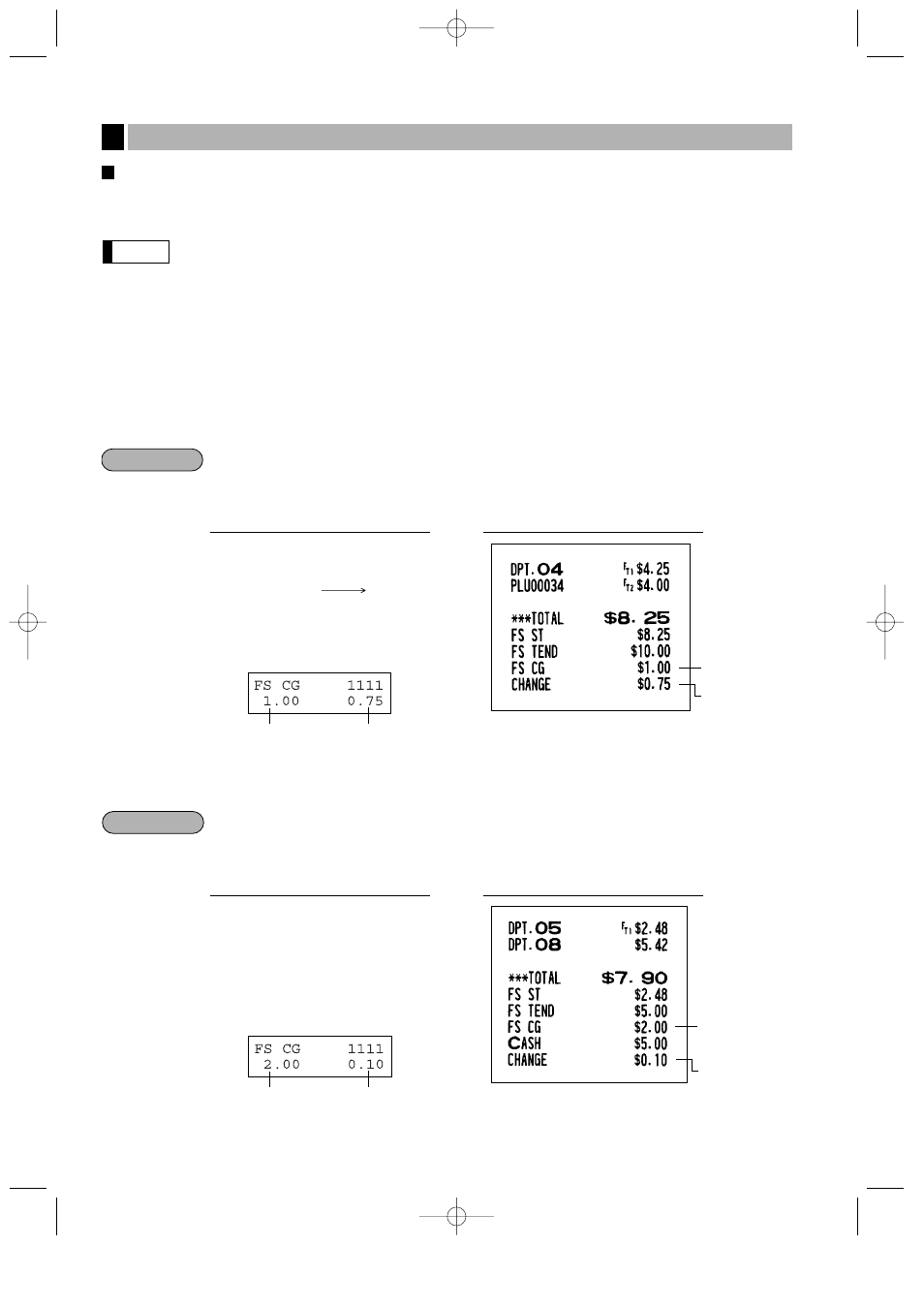

When the amount tendered in food stamps is greater than the food stamp-eligible subtotal:

Your register shows two change due amounts in its display.

The food stamp change due appears at the left of the display in dollars and the cash change at the right in cents.

• When you sell only items eligible for food stamp payment.

Your customer purchases a $4.25 item (dept.4, taxable 1, eligible for food stamp payment)

and another $4.00 item (PLU 34, taxable 2, eligible for food stamp payment) and tenders

$10.00 food stamps for them.

• Mixed sale of an item eligible for food stamps and another item not eligible for food stamps

Your customer purchases a $2.48 item (dept. 5, taxable 1, eligible for food stamps) and

another $5.42 item (dept. 8, nontaxable, ineligible for food stamps) and pays $5.00 in food

stamps and $5.00 in cash.

Display shows:

Food stamp

change

Cash

change

Food stamp

change due

Cash change

due

248

5

542

8

f

500

f

500

a

Key operation

Example

Display shows:

Food stamp

change

Cash

change

Food stamp

change due

Cash change

due

425

4

34

P

f

1000

f

To display

the food

stamp-eligible

subtotal

UPC

Key operation

Example

Note

Food stamp calculations

4

ER-A410/A420(SEC)-2 03.12.22 0:13 PM Page 40