Doing bond calculations – HP 17bII+ User Manual

Page 110

110 8:

Bonds

File name : English-M02-1-040308(Print).doc Print data : 2004/3/9

Doing Bond Calculations

Remember that values in the BOND menu are expressed per $100 face

value or as a percentage. A CALL value of 102 means that the bond will

be worth $102 for every $100 of face value when called. Some

corporate bonds in the United States use the convention that the price of

the bond is set to 100 if the coupon rate equals the yield, whether or not

the settlement date is a coupon date. The BOND menu does not use this

convention.

To calculate the price or yield of a bond:

1. Display the BOND menu: press

.

2. Press

@c

. This sets CALL=100.

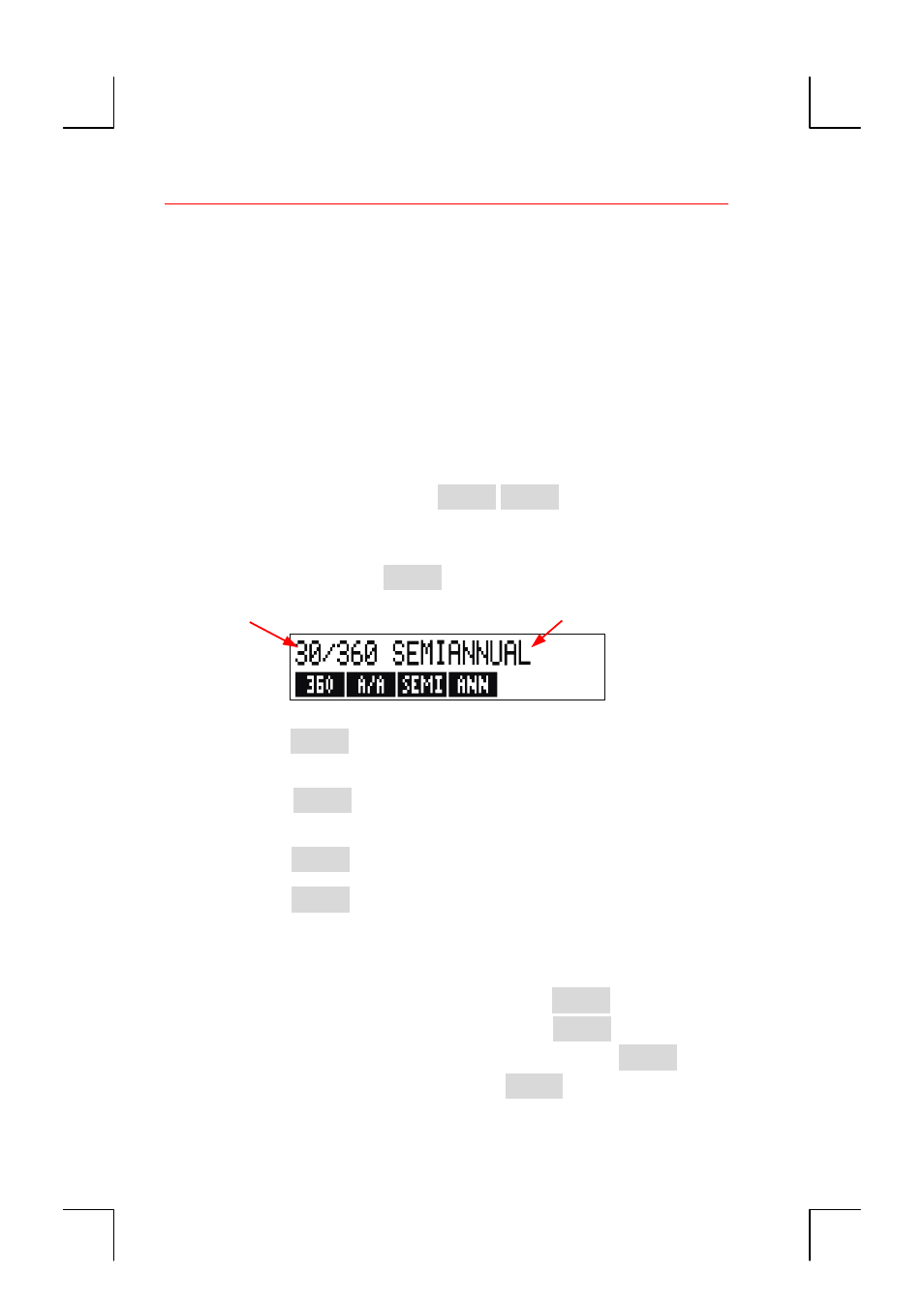

3. Define the type of bond. If the message in the display does not match

the type you want, press

.

Calendar basis Interest period

Pressing

sets the calendar basis to a 30-day month and a

360-day year.

Pressing

sets the calendar basis to the actual calendar

month and to the actual calendar year.

Pressing

sets semi-annual coupon payments.

Pressing

sets annual coupon payments.

Press

e

to restore the BOND menu.

4. Key in the settlement date (MM.DDYYYY or DD.MMYYYY depending

on the date format; see chapter 11) and press

.

5. Key in the maturity date or call date and press

.

6. Key in the coupon rate as an annual percent and press

.

7. Key in the call value, if any, and press

. For a bond held to