Programming automatic tax calculation, Getting started, Tax table programming – Casio PCR-1000 User Manual

Page 14: Programming for the u.s. tax tables procedure, Important, Programming procedure

14

Getting Started

Tax table programming

Programming automatic tax calculation

Important!

After you program the tax calculations, you also have to individually specify which departments

(page 32) and PLUs (page 35) are to be taxed.

For this cash register to be able to automatically register state sales tax, you must program its tax tables

with tax calculation data from the tax table for your state. There are three tax tables (U.S.) and four tax

tables (Canada) that you can program for automatic calculation of three separate sales taxes.

Programming for the U.S. Tax Tables Procedure

Find your state in the table (page 15 ~ 18) and input the data shown in the table.

State sales tax calculation data tables for all of the states that make up the United States are included on

the following pages.

Important!

Be sure you use the state sales tax data specifically for your state. Even if your state uses the

same tax rate percentage as another state, inputting the wrong data will cause incorrect result.

Programming procedure

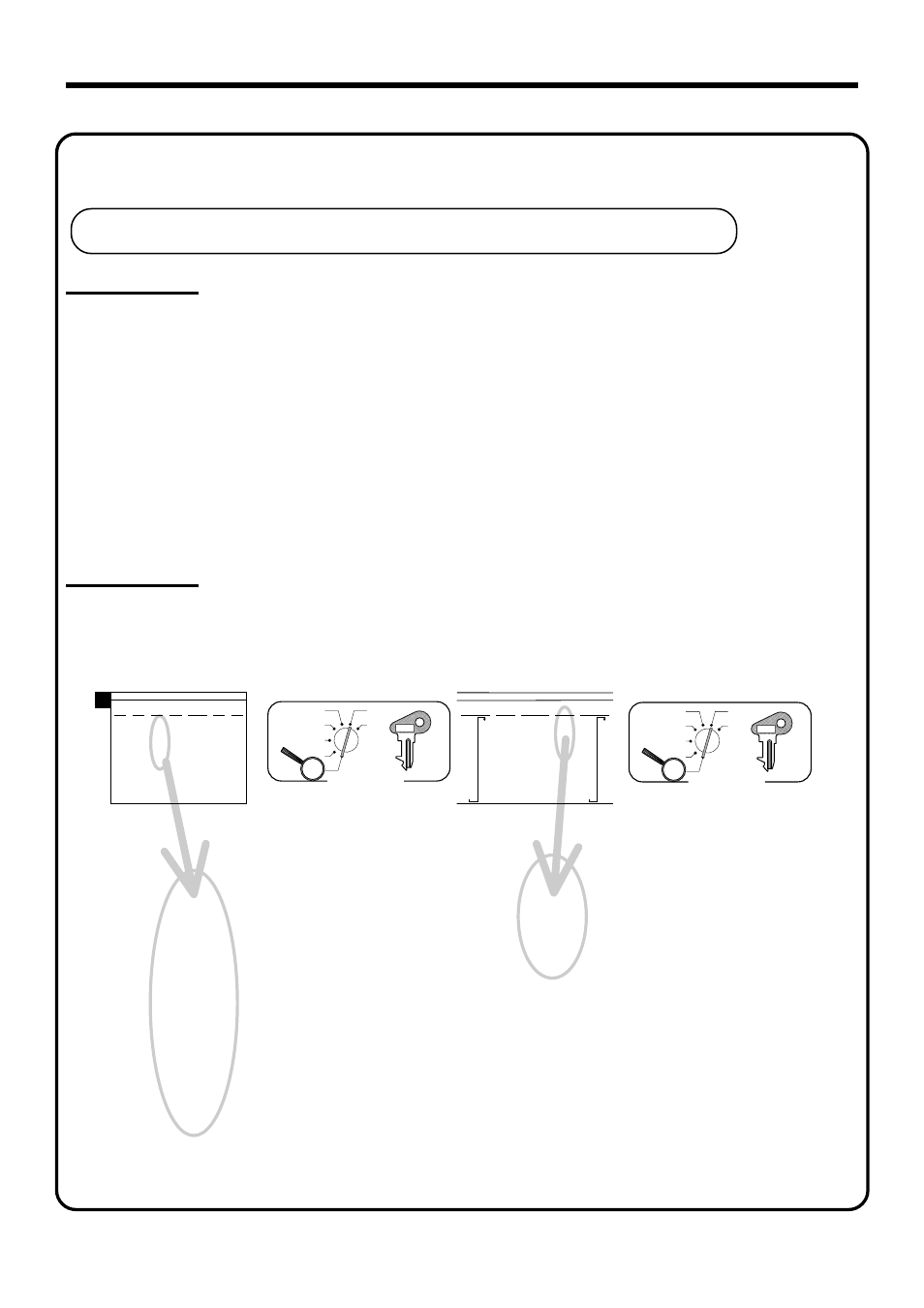

Example 1 (Alabama 6% sales tax to Tax Table 1)

Example 2 (Colorado 5.25% sales tax to Tax Table 2)

ALABAMA

4%

0

1

1

10

30

54

73

110

5%

0

1

1

10

29

49

69

89

110

6%

0

1

1

8

24

41

58

6%

0

1

1

9

20

40

55

70

90

109

7%

0

1

1

7

21

35

49

64

78

92

107

8%

0

1

1

6

18

31

43

56

68

81

93

106

6%

(4+1+1)

0

1

1

10

20

36

54

70

85

110

A

Mode Switch

X

Z

CAL

REG

OFF

RF

PGM

Assign Tax Table 1

0

1

1

8

24

41

58

Press

a

Terminate program

2

2

2

2

2

2

2

2

2

2

$

3

s

$

0125

a

$

0

a

$

1

a

$

1

a

$

8

a

$

24

a

$

41

a

$

58

a

$

a

$

s

Mode Switch

X

Z

CAL

REG

OFF

RF

PGM

Assign Tax Table 2

5.25

5002

Press

a

Terminate program

2

2

2

2

2

$

3

s

$

0225

a

$

5^25

a

$

5002

a

$

a

$

s

COLORADO

4.5%

0

1

5

17

33

55

77

99

122

144

166

188

211

233

255

277

299

5.5%

0

1

6

17

27

45

63

81

99

118

136

154

172

190

209

227

245

263

281

299

5.25%

5.25

5002

5%

0

1

2

17

29

49

LOVELAND

5%

0

1

1

18

18

51

68

84

118

P G M

C-A32

P G M

C-A32

(Tax Table 3:

0325

)

10.