Toshiba TEC MA-1300 User Manual

Page 63

Attention! The text in this document has been recognized automatically. To view the original document, you can use the "Original mode".

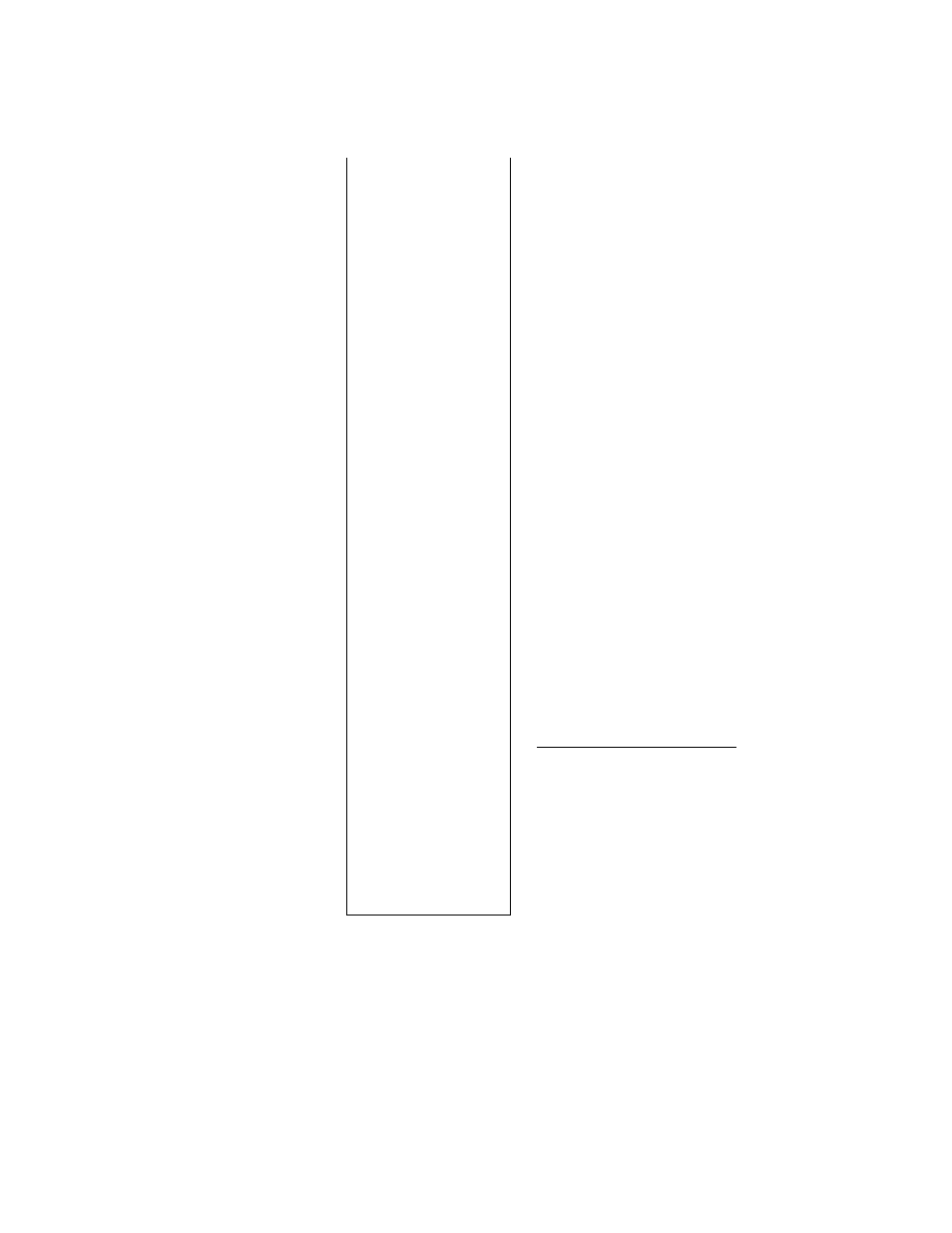

E01-11064

GST

Amount

(Value

added Tax Feature) is.

printed on CA model.

Sale Portion subject to,

GST

Exemption

is

printed on CA model.

CASH

21CU

$160.80

CHECK

4CU

$44.36

Chg

lOCU

$68.82

MISC

2CU

$19.35

CRN

OCU

$9.00

R/A

3

$192.50

PO

2

$7.70

CASH 10

$109.77

CHECK ID

7

$65.00

MISC ID

4

$20.50

CRN ID

3

$9.00

CORR

2

$9.00

VOID

1

$1.00

ALL VD

2

$22.00

%-

1

$0.10

S.CPN

1

$2.00

RTN

1

$5.00

-TAX

$0.50

REG-

1

$11.93

TXBLl

$210.18

TXBL2

$169.04

TAX EX

ICU

TAXIEX

$6.70

TAX2EX

$3.20

CURl

3

1150.00

JONES

G S

160

$337.00

OTHER TL

2

$22.00

JONES

0066 21:19

Cash Sales Customer Count

Amount

Check Sates Customer Count

Amount

Charge Sales Customer Count

Amount

Misc. Sales Customer Count

Amount

Coupon Sales Customer Count

Amount

Received-on-Account Count

Amount

Paid-Out Count

Amount

Cash-in-drawer Amount

Check-in-drawer Count

Amount

Misc. -in-drawer Count

Amount

Coupon-in-drawer Count

Amount

Item Correct Count

Amount

Void Count

Amount

All Void Count

Amount

Percent Discount on Line Items Count

Amount

Store Coupon Count

Amount

Returned Merchandise Item Count

Amount

Negative Tax Amount

Negative Mode (El) Count

. Total Amount

Taxable Total i

Taxable Total 2

Tax Exempted Customer Count

Sale Portion subject to Tax 1 Exemption

Sale Portion subject to Tax 2 ^emotion

Foreign Currency l -in-drawer Courit

Amount

Clerk Name

Gross Sale Item Count

Amount

Other Income Sales Total Count

Amount

GST Taxable Total (Sale

Amount Portion subject to

GST taxation) is printed on

CA model.

New Net Sale Amount

printed on CA model.

-59 -