International micr standards, How micr works, The micr check – TROY Group MICR Basics Handbook User Manual

Page 6

Section 1 Understanding MICR

MICR Basics Handbook -- Document #50-70300-001 Rev. C

1-2

Specially designed E-13B or CMC-7 fonts are used for magnetically reading financial documents. The

following table lists the countries currently using E-13B or CMC-7:

E-13B

CMC-7

United States of America

France

Canada Spain

Australia Israel

United Kingdom

Other Mediterranean Countries

Japan

South America (except Colombia)

India

Mexico

Colombia

Turkey

Within the next few years, most of the economically developed/developing countries will have installed

or will be installing MICR processing systems. As for MICR printing, no other financial processing

system of the electronic age is so widely recognized for its reliability, durability, and economic feasibility.

No other payment transfer system is so broadly accepted by the business community and general public.

International MICR Standards

This TROY MICR Basics Handbook provides details for MICR specifications and guidelines that apply

to the United States. For information on International MICR specifications and guidelines, refer to the

ISO-1004 standards document.

How MICR Works

The E-13B information needed by clearing houses and banks is printed in magnetic ink near the bottom of

the document. After printing, the documents are then processed mechanically and electronically through

a reader-sorter machine. This machine magnetically reads pertinent information about the check,

including the amount of the check, account number, institution upon which the check was drawn and

other miscellaneous transaction codes.

During the clearing process, the E-13B characters are read several times, at extremely high speeds (less

than 1/1000th-of-a-second per character). Therefore, for MICR to work successfully, the MICR

characters must be accurately printed on a document according to precise specifications.

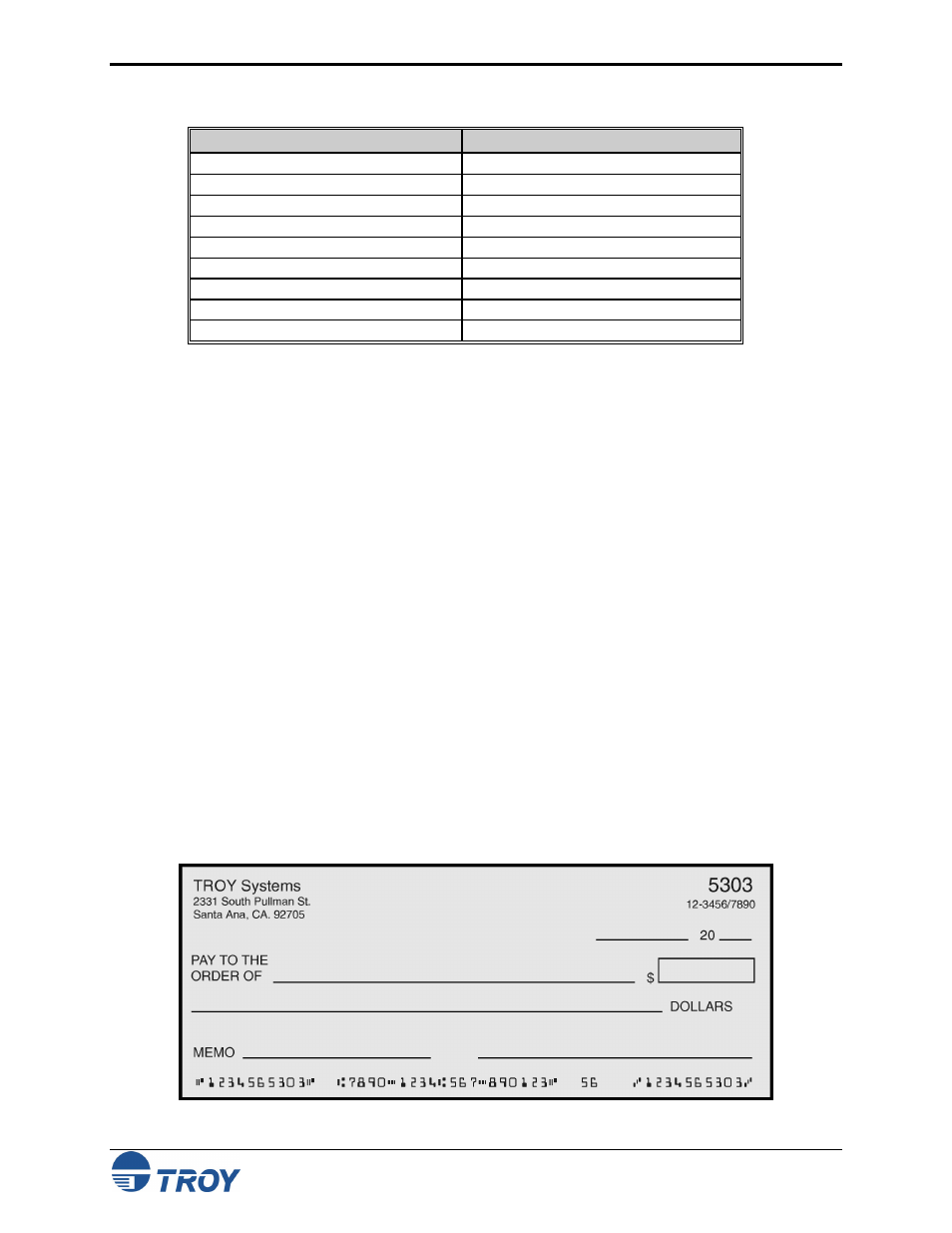

The MICR Check

This section provides information about the design and printing of MICR checks. A typical business

check is shown below in Figure 1-1.

Figure 1-1: Typical MICR Check