Tax status shift, T u p, T u ¡ ¡ a – Sharp Electronic Cash Register XE-A403 User Manual

Page 22

20

Tax status shift

The machine allows you to shift the programmed tax status of each department or the PLU key by pressing the

T

and/or

U

keys before those keys. After each entry is completed, the programmed tax status of each

key is resumed.

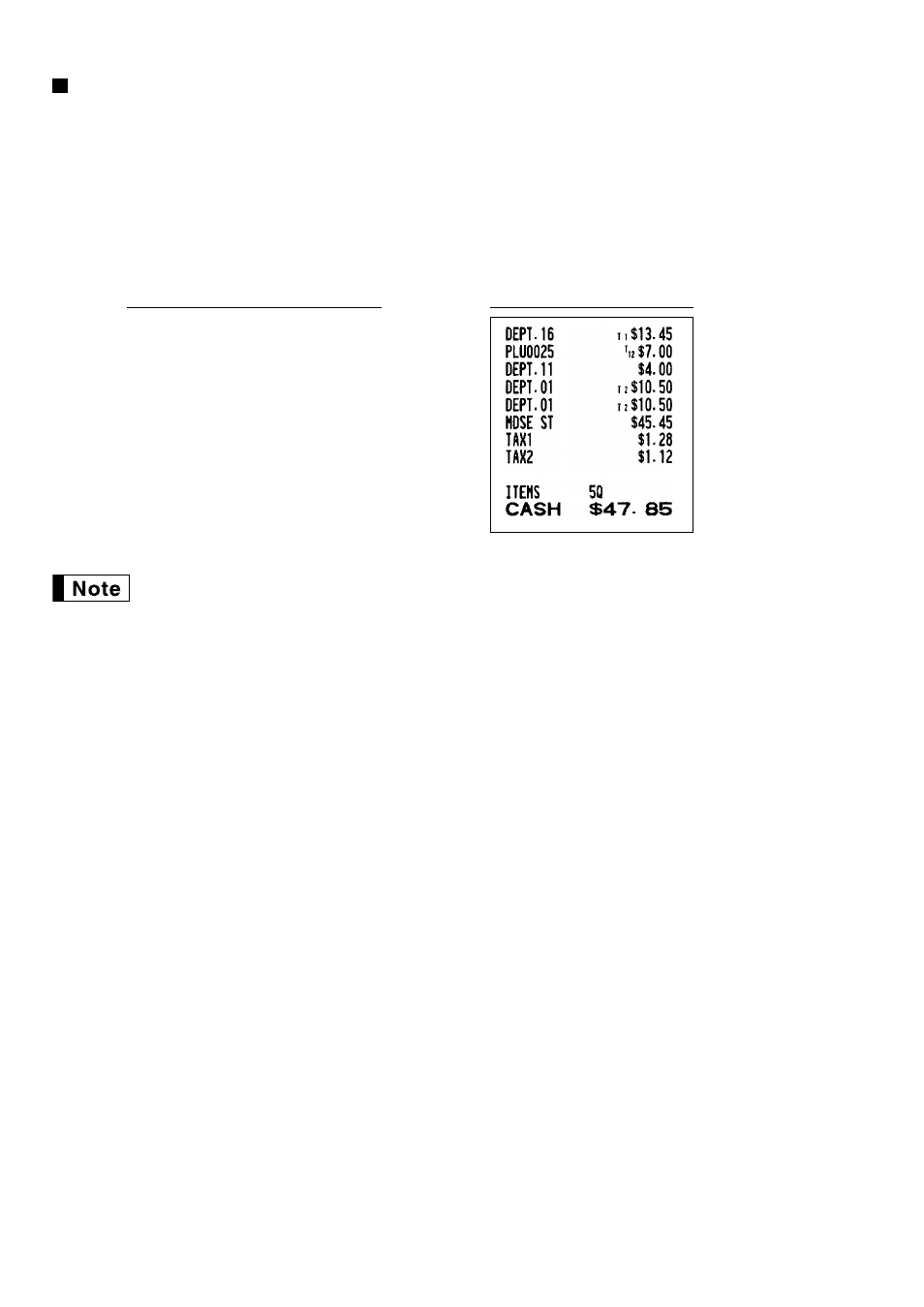

Example: Selling the following items for cash with their programmed tax status reversed

• One $13.45 item of dept. 16 (non-taxable) as a taxable 1 item

• One $7.00 item of PLU 25 (non-taxable) as a taxable 1 and 2 item

• One $4.00 item of dept. 11 (taxable 2) as a non-taxable item

• Two $10.50 items of dept. 1 (taxable 1) as taxable 2 items

When Canadian tax system is applied:

When using a tax status shift, the entry of a multi-taxable item for PST or GST will be prohibited.

Please see below:

In case of; Tax 1: PST, Tax 2: PST,

Tax 3: PST, Tax 4: GST

Taxable 1 and 2 item ········· prohibited

Taxable 1 and 3 item········· prohibited

Taxable 2 and 3 item ········· prohibited

Taxable 1 and 4 item ············· allowed

Taxable 2 and 4 item ············· allowed

Taxable 3 and 4 item ············· allowed

In case of; Tax 1: PST, Tax 2: PST,

Tax 3: GST, Tax 4: GST

Taxable 1 and 2 item ········· prohibited

Taxable 1 and 3 item ············· allowed

Taxable 2 and 3 item ············· allowed

Taxable 1 and 4 item ············· allowed

Taxable 2 and 4 item ············· allowed

Taxable 3 and 4 item ········· prohibited

1345

T ¥

25

T U p

400

U œ

1050

T U ¡

¡

A

Receipt print

Key operation example