Advanced programmings and registrations – Casio SE-S3000 Manual User Manual

Page 70

E-70

Advanced programmings and registrations

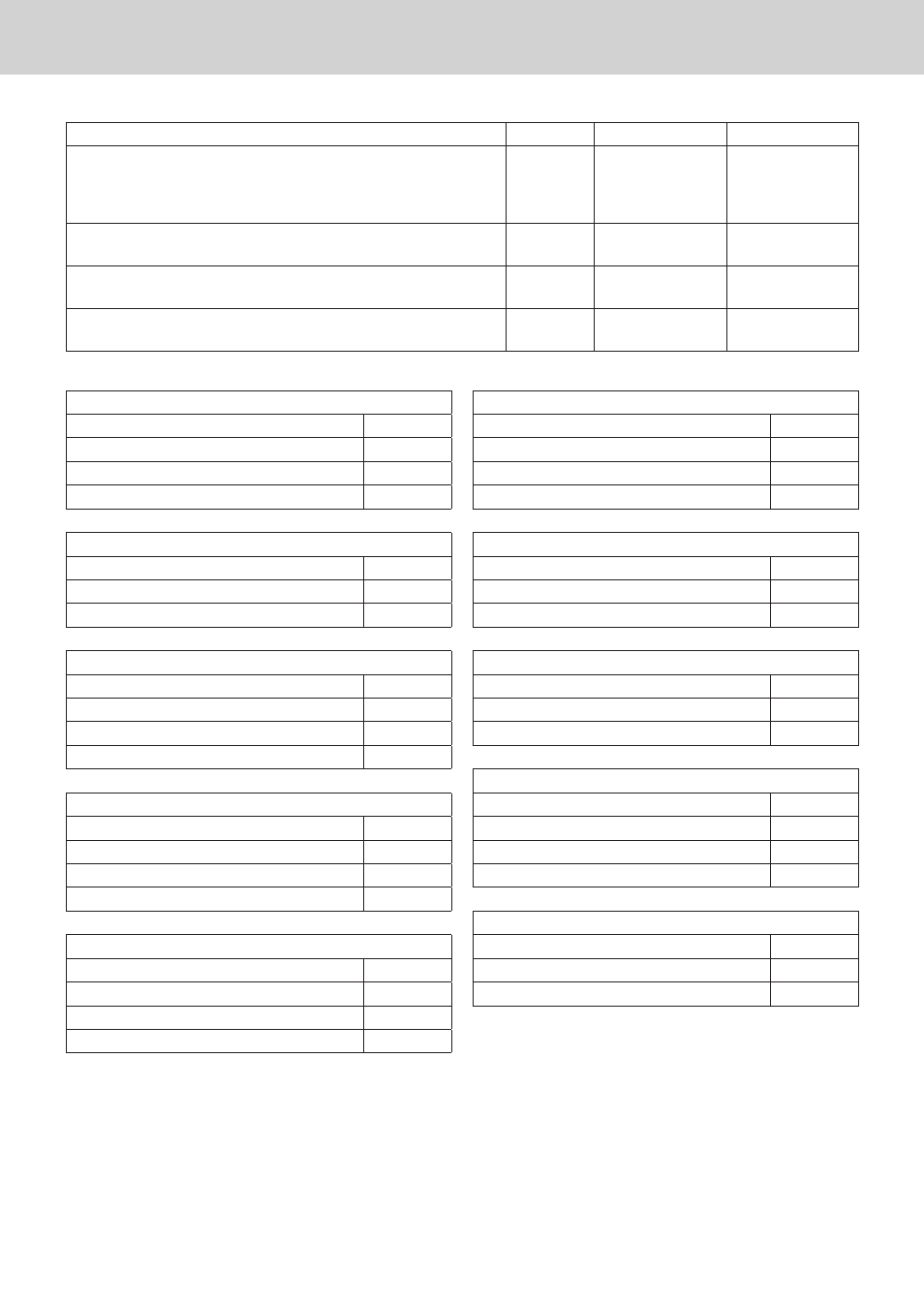

Set code 04 (Tax and rounding systems)

Description

Selection

Program code

Initial value

Apply rounding for registration: No rounding = 0, IF1 = 1, IF2 = 2,

Danish = 3, Singaporean = 5, Finnish = 6, Australian = 7, South

African = 8, Other roundings = 9 (Refer to D1)

See the following tables for IF1 and IF2

0 to 9

B

D10

º

D10

Tax system:

Single tax system (1 ~ 4) = 0, Singaporean tax system = 3

0 or 3

B

D9

º

D9

Must be “0000000”

BB

D8 to D2

ºº

D8 to D2

Other rounding: New Zealander (A) = 0, New Zealander (B) = 1 ,

Malaysian = 2, Norwegian/Czech = 3 (D10 must be set to “9”.)

0 to 3

B

D1

º

D1

Rounding systems for each country

IF 1 rounding

Australian rounding

Last digit of ST

Result

Last digit of ST/CA CG

Result

0 to 2

0

0 to 2

0

3 to 7

5

3 to 7

5

8 to 9

10

8 to 9

10

IF 2 rounding

South African rounding

Last digit of ST

Result

Last digit of ST

Result

0 to 4

0

0 to 4

0

5 to 9

10

5 to 9

5

Danish rounding

New Zealander (A/B) rounding

Last 2 digits of ST/CA CG

Result

Last digit of ST/CA CG

Result

00 to 24

00

0 to 4/5

0

25 to 74

50

5/6 to 9

10

75 to 99

100

Malaysian rounding

Singaporean rounding

Last digit of ST/ CA CG

Result

Last digit of item, %- REG

Result

0 to 2

0

0 to 2

0

3 to 7

5

3 to 7

5

8 to 9

10

8 to 9

10

Norwegian/Czech rounding

Finnish rounding

Last digit of ST

Result

Last digit of ST/CA CG

Result

00 to 49

00

0 to 2

0

50 to 99

100

3 to 7

5

8 to 9

10