Toshiba MA-132 SERIES User Manual

Page 44

Attention! The text in this document has been recognized automatically. To view the original document, you can use the "Original mode".

3. 7o RATE ONLY

107o applied to any amount

D |TX/^|

[m,_______

1000 lAT/TLl

NON-TAXABLE AMOUNT LIMIT SETTING

CONDITION: After an Auto Reset; this program is applied only to

restaurants in Province of Quebec, Canada.

If this program has been set, the tax is calculated and added to the

sale total which exceeds the limit amount even when the sale is

entirely composed of non-taxable items. The tax levied when exceeding

this limit amount will be calculated by the Tax 1 Table which has

just been described.

OPERATION; Control Lock; SET, one of the Clerk Keys must be set to ON.

9 S ^

I

Non-taxable Limit Amount | -+ | AT/TL I

max. 4 digits ($99.99)

NOTES:

1. To reset the limit amount once set, enter "0" as the "Non-

taxable Limit Amount" in the above operation.

2. This tax calculation program will be disregarded when the sale

total is negative.

ex.) When the limit amount is set to "$3.25":

Case 1) Norma 1 Department Entry (Control Lock: REG)

1 326 I

-f

|7ion-taxab le DEPT | -»■ rAtTTL'l

... The entered amount $3.26 is greater than the limit

$3.25, It will therefore be taxed.

Case 2) Returned Merchandise Entry (Control Lock: REG)

RTN MDSE

3261 Inon-taxable DEPTI I AT/TL

... The non-taxable total is negative. The tax already

levied will therefore not be returned.

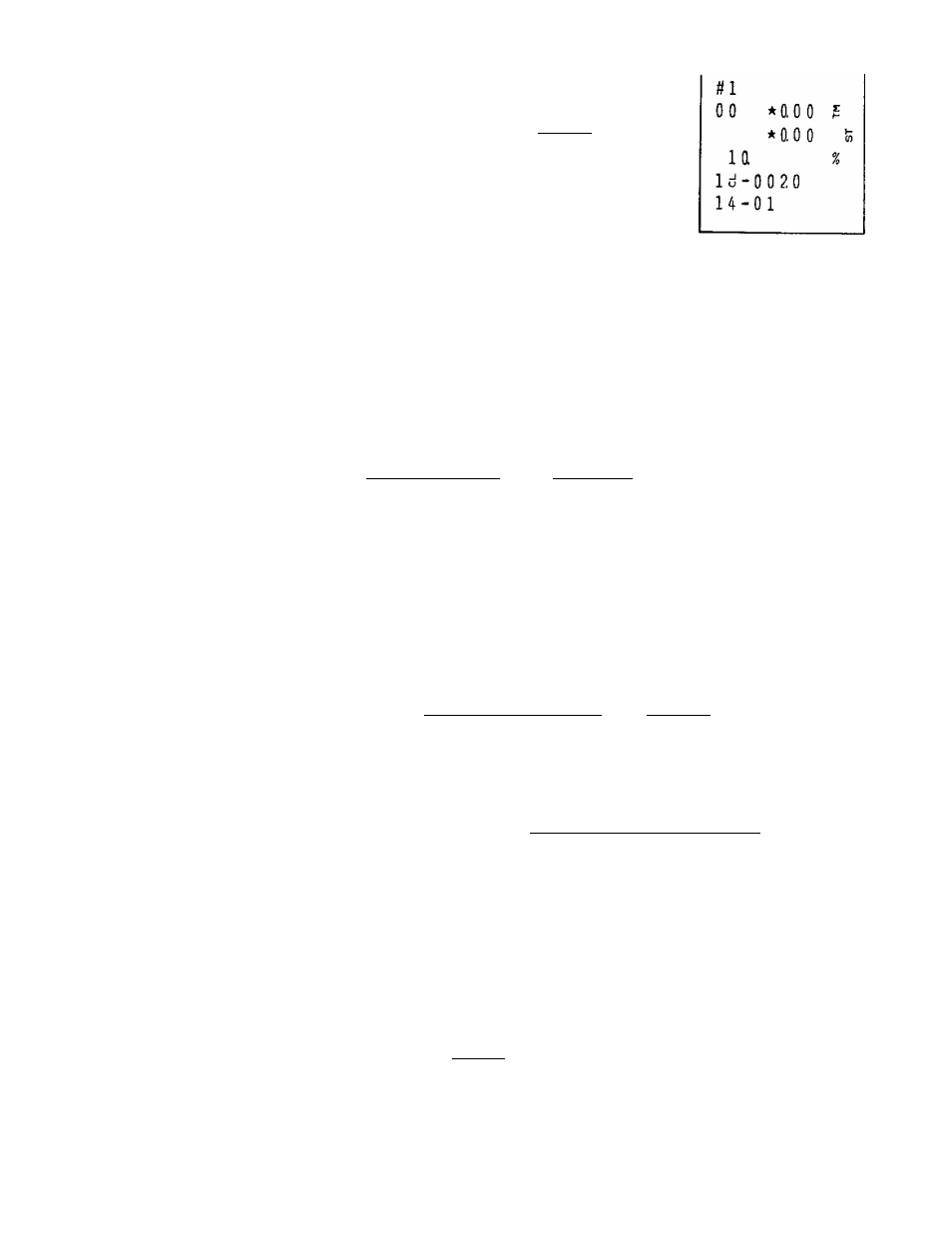

SAMPLE OPERATION;

To set the Non-taxable Amount to $20.00:

Control Lock: SET,

Clerk 1 Key to ON.

Enter 9, depress

[x

].

Enter 2000, depress |AT/TL|.

Thank you

Coll again

0 6 . - 0 4 . - 8 4

go

//-0.9

* 2 0.0 0

1 d - 0 01. ?

1 3 - 5 8

- 40 -