Ba sic func tion, Tax shift – Casio PCR-T500 User Manual

Page 39

E-39

Ba

sic func

tion

To use the cash register’s basic function

Tax shift

By using

t

or

T

keys, you can change the taxable status.

The

t

key switches on and off of programmed taxable status 1 and

T

key

changes the taxable status 2. The following table explains how tax statuses

change by

t

or

T

key.

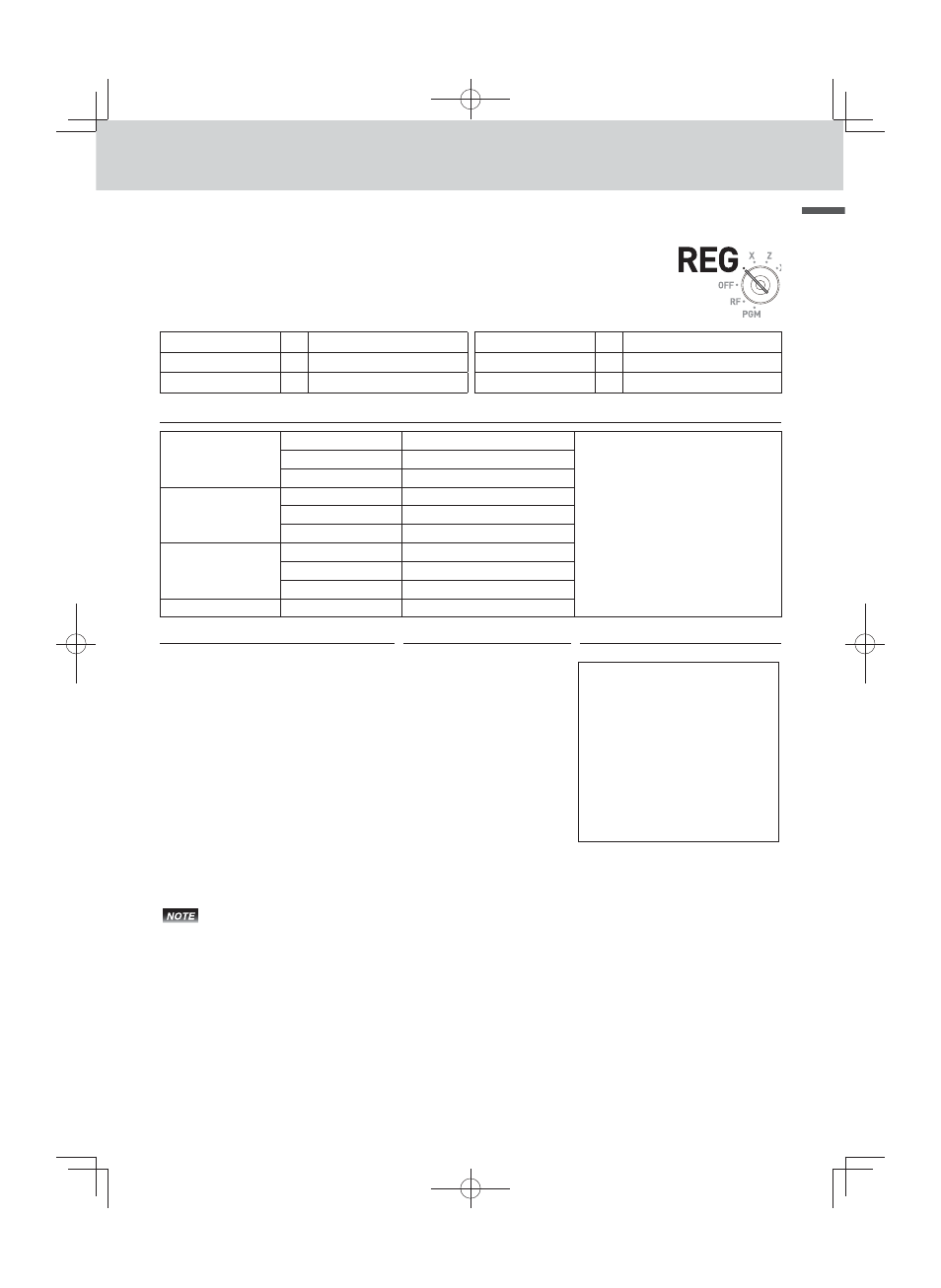

Non tax

t

6 Tax status 1

Non tax

T

6 Tax status 2

Tax status 1

t

6 Non-tax

Tax status 1

t

6 Tax status 1 & 2

Tax status 2

t

6 Tax status 1 & 2

Tax status 2

t

6 Non-tax

Sample Operation

Item 1

Dept. 01

$2.00

• Item 1 is shifted from non-taxable to

tax status 1 by

t

key.

• Item 2 is shifted from tax status 1 to

tax status 1 & 2 by

T

key.

• Item 3 is shifted from tax status 2 to

non-taxable by

T

key.

• Preset tax rates : Tax 1 = 4%

Tax 2 = 5%

Quantity

1

Taxable

Non tax (preset) to tax status 1

Item 2

Dept. 02

$6.00

Quantity

1

Taxable

Tax status 1 (preset) to 1 & 2

Item 3

Dept. 03

$7.00

Quantity

1

Taxable

Tax status 2 (preset) to non-tax

Payment

Cash

$30.00

Step

Operation

Printout

1

Press

t

then register item 1. The

tax status of the item 1 is changed

from non-taxable to tax status 1.

t2'!

1 DEPT001 T1

$2.00

1 DEPT002 T12 $6.00

1 DEPT003

$7.00

TA1

$8.00

TX1

$0.32

TA2

$6.00

TX2

$0.30

TL

$15.62

CASH

$20.00

CG

$4.38

2

Press

T

then register item 2. The

tax status of the item 2 is changed

from tax status 1 to tax status 1 & 2.

T6'"

3

Press

T

then register item 3. The

tax status of the item 3 is changed

from tax status 2 to non-taxable.

T7'#

4

Press

o

key to indicate the

total amount including tax.

o

5

Enter tendered amount and press

F

to fi nalize the transaction.

20'F

• To change the tax status of the next item to be registered, be sure to press

t

,

T

.

• If the last item registered is programmed as non-taxable, a discount (

p

key) operation on this

item is always non-taxable. In this case, you cannot manually change the tax status to taxable

1 or 2 by pressing

t

,

T

keys.