Example: computing perpetual annuities – Texas Instruments BA II PLUS User Manual

Page 34

30

Time-Value-of-Money and Amortization Worksheets

Answer:

The present value of the savings is $122,891.34 with an ordinary

annuity and $135,180.48 with an annuity due.

Example: Computing Perpetual Annuities

To replace bricks in their highway system, the Land of Oz has issued

perpetual bonds paying $110 per $1000 bond. What price should you pay

for the bonds to earn 15% annually?

Answer:

You should pay $733.33 for a perpetual ordinary annuity and

$843.33 for a perpetual annuity due.

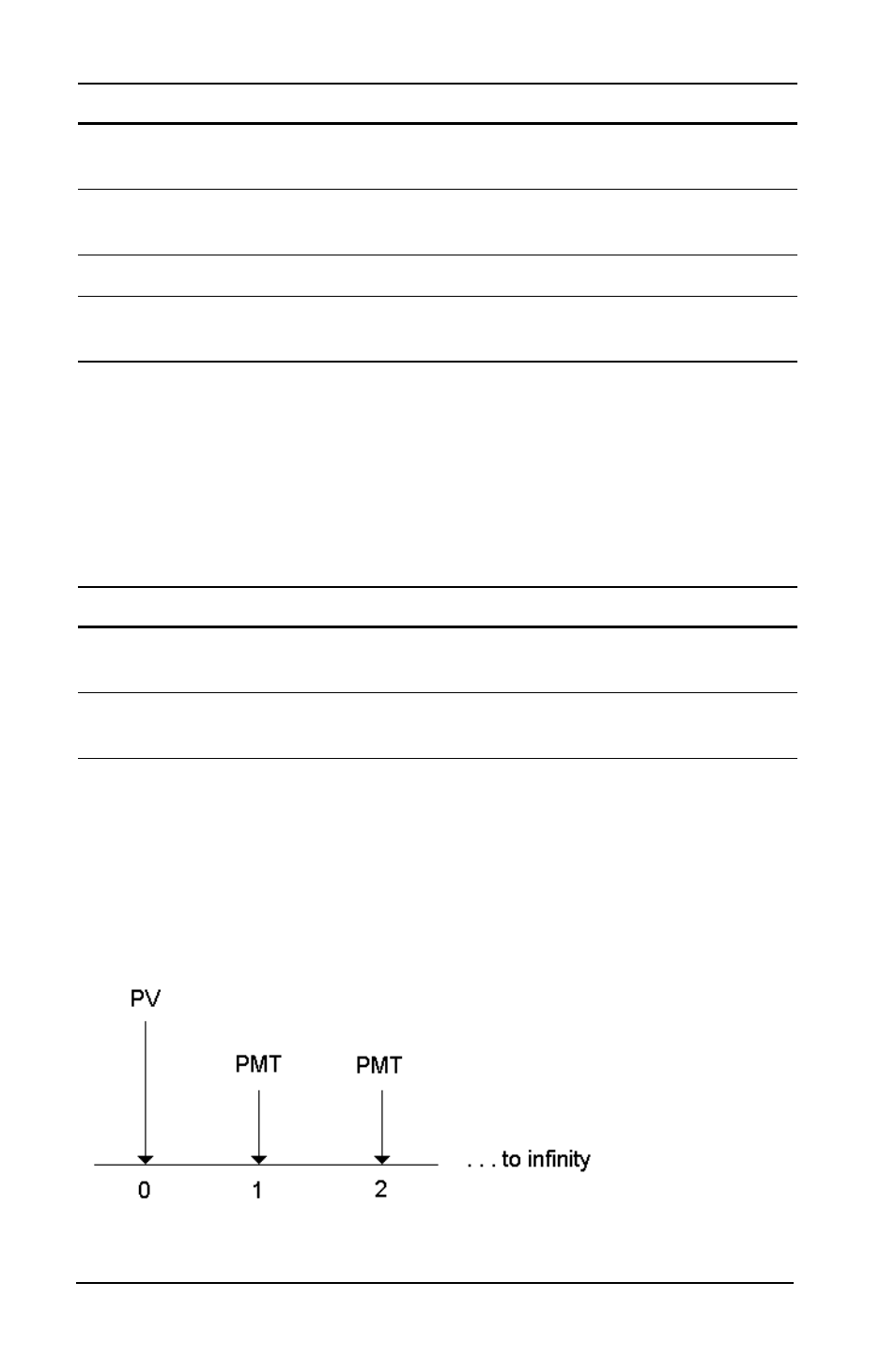

A perpetual annuity can be an ordinary annuity or an annuity due

consisting of equal payments continuing indefinitely (for example, a

preferred stock yielding a constant dollar dividend).

Perpetual ordinary annuity

Compute present value

(ordinary annuity).

% .

PV=

122,891.34

Set beginning-of-period

payments.

& ] & V

BGN

Return to calculator mode.

& U

0.00

Compute present value

(annuity due).

% .

PV=

135,180.48

To

Press

Display

Calculate the present value for a

perpetual ordinary annuity.

110

6

15

2 N

733.33

Calculate the present value for a

perpetual annuity due.

H

110

N

843.33

To

Press

Display