EdgeWare FastBreak Pro Version 6.5 User Manual

Page 75

75

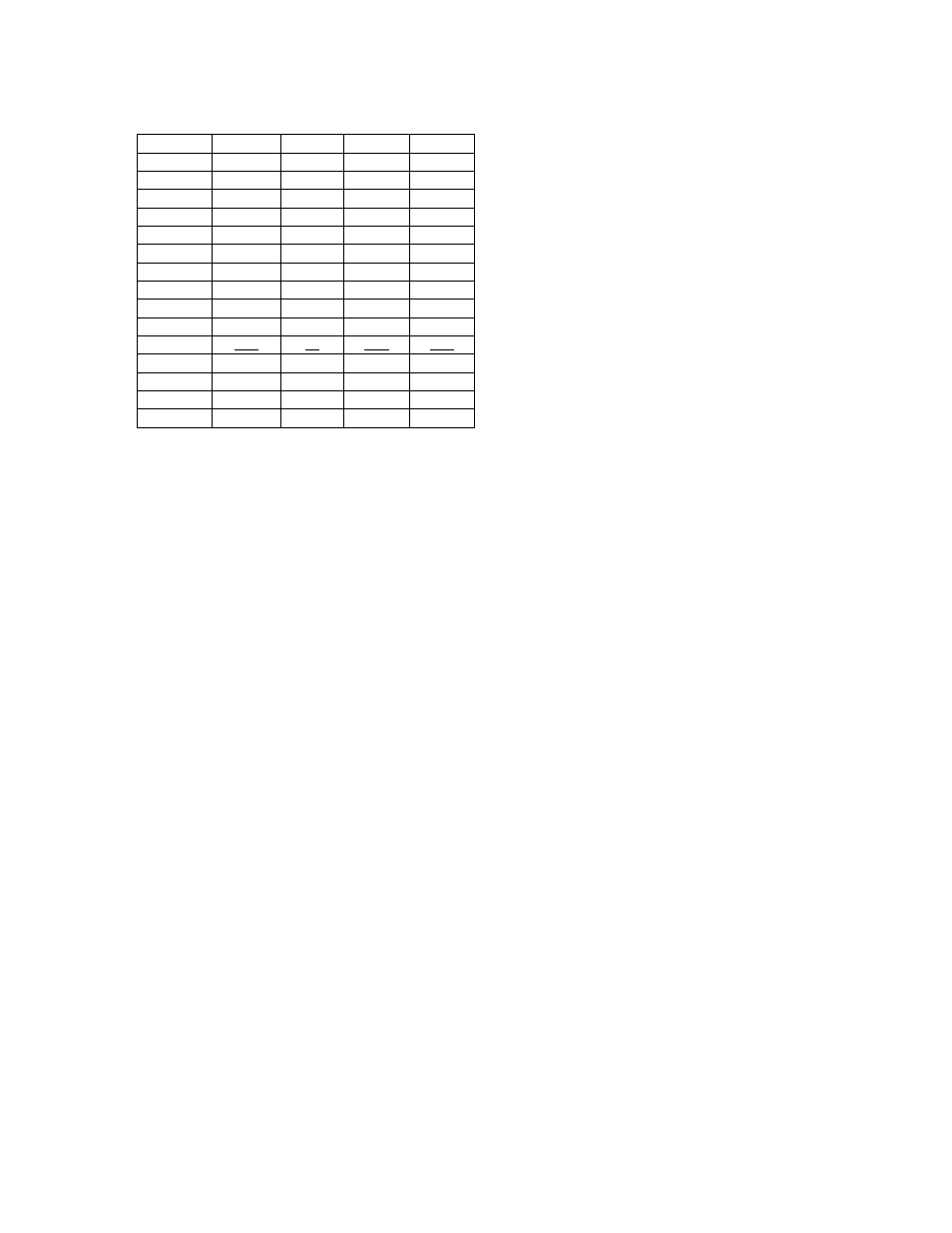

System

OS Return

FNU OS

Post OS

FNU Post

Number

Annual, % Annual,% Annual, % Annual, %

1

38.5

44.6

17.7

20

2

28.7

37.7

23.3

21.1

3

5.8

33

32.2

32.1

4

41.7

8.7

23.3

24

5

27.4

40.9

21.8

31.2

6

22.8

24.9

24.8

29.7

7

33.8

19.1

19.9

12.4

8

29.2

26

37.3

38.2

9

51.7

34.3

45.8

48.7

10

45.5

50

24.4

26.9

Average

32.5

31.9

27

28.4

S&P

37.2

37.2

14.7

14.7

Family Avg.

32.6

32.6

11.3

11.3

On average, using the FNU equity curve to measure performance shows a slight

improvement in both the OS and Post OS Period. What is important is how individual

trading systems are affected.

For example, cases number 3 and 4 show dramatic

differences in the OS period. Although not as dramatic, we see similar results with case 7

in the Post OS period.

We recommend that the FNU files be generated when doing the final decision making on

which system to trade.

Double Period Out-of-Sample Testing (International Funds)

Here are the results from a study that looks at double period out-of-sample testing. It is

similar to the previous study performed with the Select funds.

IS optimization started on 1/4/1993 and ended on 10/1/1996, with an OS period from

10/1/1996 to 4/1/1998.

A Post OS period evaluation was made from 4/1/1998 to

9/10/1999. Two funds were held using MAM, an MDD of 15%, and a goal of 9 S/Y.

Here is the FastBreak Pro Out-of-Sample Results Screen: