Day three – FujiFilm FinePix Real 3D W3 User Manual

Page 25

23

23

rd

SEPTEMBER 2010

Day Three

world of imaging

2010

The Indian imaging market

shows positive trend in 2010

T

he Digital Still Camera is rapidly

strengthening its hold over the Indian

Market. The business is constantly

evolving. Aspiration and affordability is

driving people to multiple ownership and

driving up the market. Companies on their

part are innovating on design, functionality,

technology and even tweaking price to attract

buyers.

The challenge for the manufacturers today

is to provide the best of features and quality

at the most affordable prices as consumers

today look out for value for money. Touch

screen cameras, Optical zoom, Image stabilizer

are few of the popular features that an India

consumer looks out for while purchasing a

camera.

Digital Cameras market witnessed a great

boom in H1 2010, especially during the months

of May and June. This is primarily attributed

to Summer Holiday season and new model

introductions from major players. Small

brands like Nikon, Fujifilm and Samsung

grew well due to their new enhanced models

and increasing market awareness about their

presence.

Around 0.46 million units were sold in

Jan-June’09 period with business of worth

INR 4.1 billion being conducted. The reported

10 towns witnessed a growth of 33 % in units

and 22 % in value over Jan-June’09 period.

Summer/ Vacation season (April-June) 2010

showed huge growth of 44% in units and 31%

in value vs last year, according to GfK Retail

and Technology

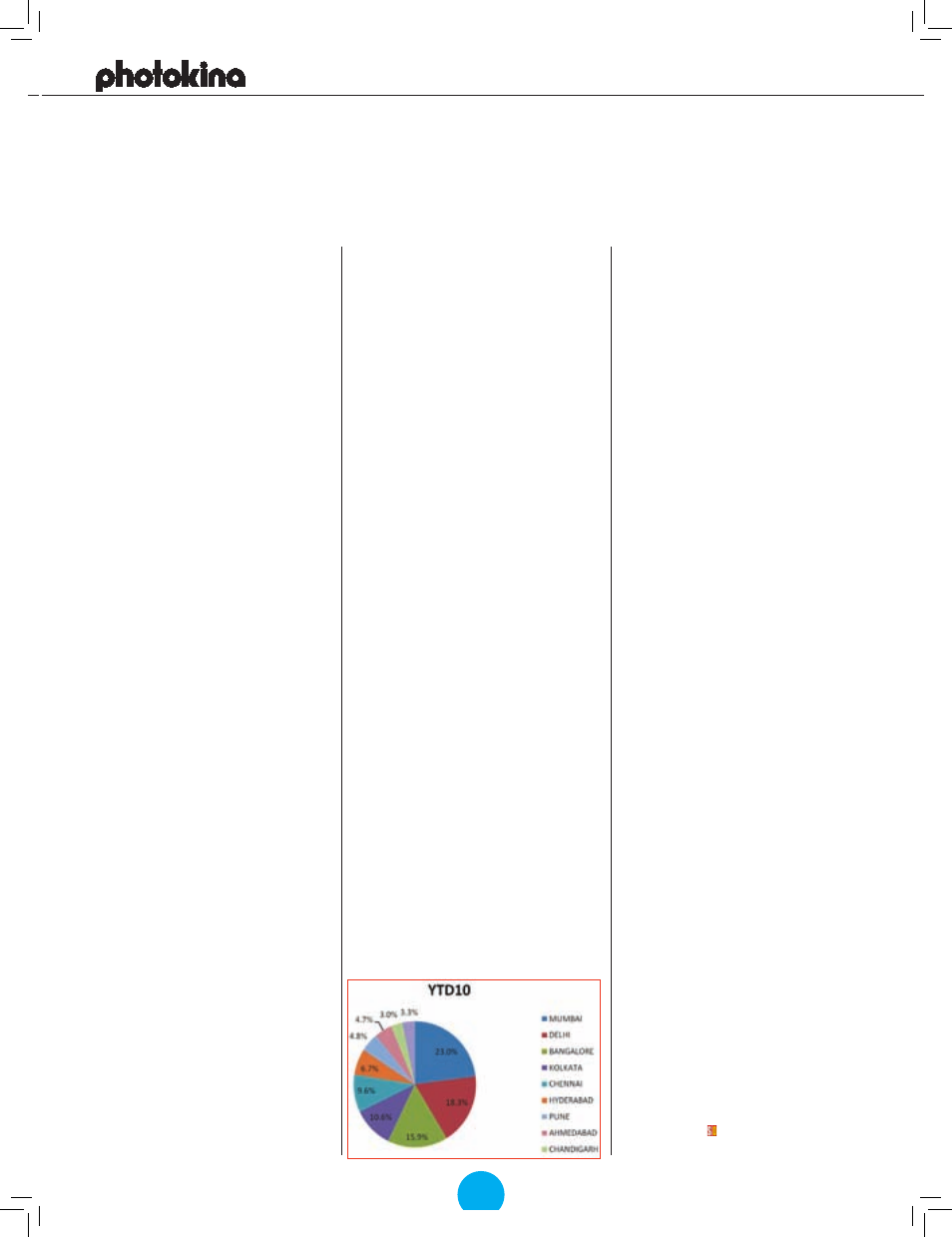

In H1 2010, Mumbai is the highest

contributor to DSC market (23%), followed

by Delhi (18.3%) and Bangalore (16%).

Growth is very well visible in smaller towns,

like Ahmedabad (68%), Pune (40%) and

Hyderabad (40%). These 3 are the potential

markets for the brands to focus on.

Higher purchasing power and exposure

to better photographic devices through use of

mobile phones has opened a huge market in

small cities that Brands are aiming to tap.

Digital SLRs are a growing segment in

Digital still camera. Though Compact Digital

Cameras still command 93% of the pie in terms

of value, SLR segment has witnessed 22%

of Value growth over YTD’09. The growing

demand for single-lens reflex cameras is

visible as the customer base has spread from

professionals and camera enthusiasts to casual

users.

Feature Trends continue to indicated

upward Trend in Higher Megapixels. The

growth in the DSC market is primarily due to

the growth in the higher resolution segments.

10 MP and above segments have grown

phenomenally in 2010, as explained by chart

below.

Effective pixels segments 10 MP and above

have experienced huge price reductions, to the

extent of 25%. This reason, alongwith better

technology and superior features have led to a

good growth of this segment.

Though 4-6X optical zoom segment has

highest contribution, but higher optical zooms

have increased significantly in H1’10, thus

showing increasing awareness of consumers

towards the advantages of the higher optical

zoom camera.

Sony is market leader with 34% unit

share and 35% value share in H1’09 period.

In this period, around 13 new models have

been captured in this period out of which

DSC-W210, DSC-S950, LCD monitor size.

As visible from the chart below, large

screen sizes are gaining popularity among

consumers. This is because a bigger screen

means one can see the detail more easily when

composing photos, makes reviewing photos

and showing them more enjoyable and finally

helps ensure the camera menus are larger and

more readable.

Price erosion happening across segments,

but due to shifting of the consumers towards

higher resolution cameras and increase of SLR

contribution to the total DSC market, the price

erosion of the overall category has been more

or less stable. The drop at a total DSC level is

approx 7%.

The Independent Non Photo Channel

experienced enormous growth of 60% in

YTD’10 over YTD’09. This over-shadowed

9% growth in Independent Photo channel.

Similarly, the contribution of National

chains has increased from 10% to 16% in

YTD’10. This shows that consumers are

moving more towards the “One stop shop” i.e.

organized retail for making their purchases.

This is mainly because the organized retail

provides better discounts and deals throughout

the year to the consumers.

Kodak’s Easyshare C140 is the top selling

model in H1’10. It contributes to 8% of the

total market size of DSC from Jan-Jun’10.

This model was launched in April’09 and was

at its peak from Sep’09 to Mar’10. Though

it is at its declining stage, but is still over

performing others. 2nd position is grabbed by

Sony’s CYBER-SHOT DSC-W320, which

contributes to 4% of the market share. This

model was launched in Jan’10 and it soon

picked up sales to be ranked as No. 2 at the

end of H1’10. The 3rd position is enjoyed

by Canon’s POWERSHOT A480, which

contributes to 3.8% of the DSC market. This

model was launched in Apr’09 and is in its

declining stage. For June’10, CYBER-SHOT

DSC-W310 and CYBER-SHOT DSC-W320

from Sony are the top selling models, together

contributing to nearly 12% of June’10 Market

Share.

There was the launch of 14.6 MP NX10

series from Samsung in India. This camera

features AMOLED screen which is claimed

to be better in performance than conventional

LCDs.

Fujifilm added high definition (HD)

capability to its 14 new models launched in

April’10 in Indian Market. FujiFilm India has

geared up to offer a completely new experience

to Indian customers with added HD attraction

in their already existing line and by bringing

in new fully-featured cameras. Nikon aiming

to strengthen its Market share in Single Lens

Reflex (SLR) camera market in India. Canon

focusing on smaller towns to gain out of these

potential markets.

The first half of 2010 witnessed

enormous growth of 33% in units and

22% in value. Companies are generating

stiff competition by introducing newer,

stylish, convenient and competent models at

affordable prices. Photography now is not

only limited to professional photographers;

the number of casual users is increasing with

time, all thanks to growing income and our

better awareness about new technologies.

Consumers’ shift to enhanced features of

higher optical zoom, higher range of pixels,

touchscreen etc. proves this point.

Due to this, not only larger, but even

the smaller towns are emerging as potential

markets, which the Industry leaders are aiming

to tap for future.

Courtesy The GfK Group