Day three – FujiFilm FinePix Real 3D W3 User Manual

Page 20

18

23

rd

SEPTEMBER 2010

Day Three

world of imaging

2010

The New Print Model: Grouped

and Bound into a Photobook

I

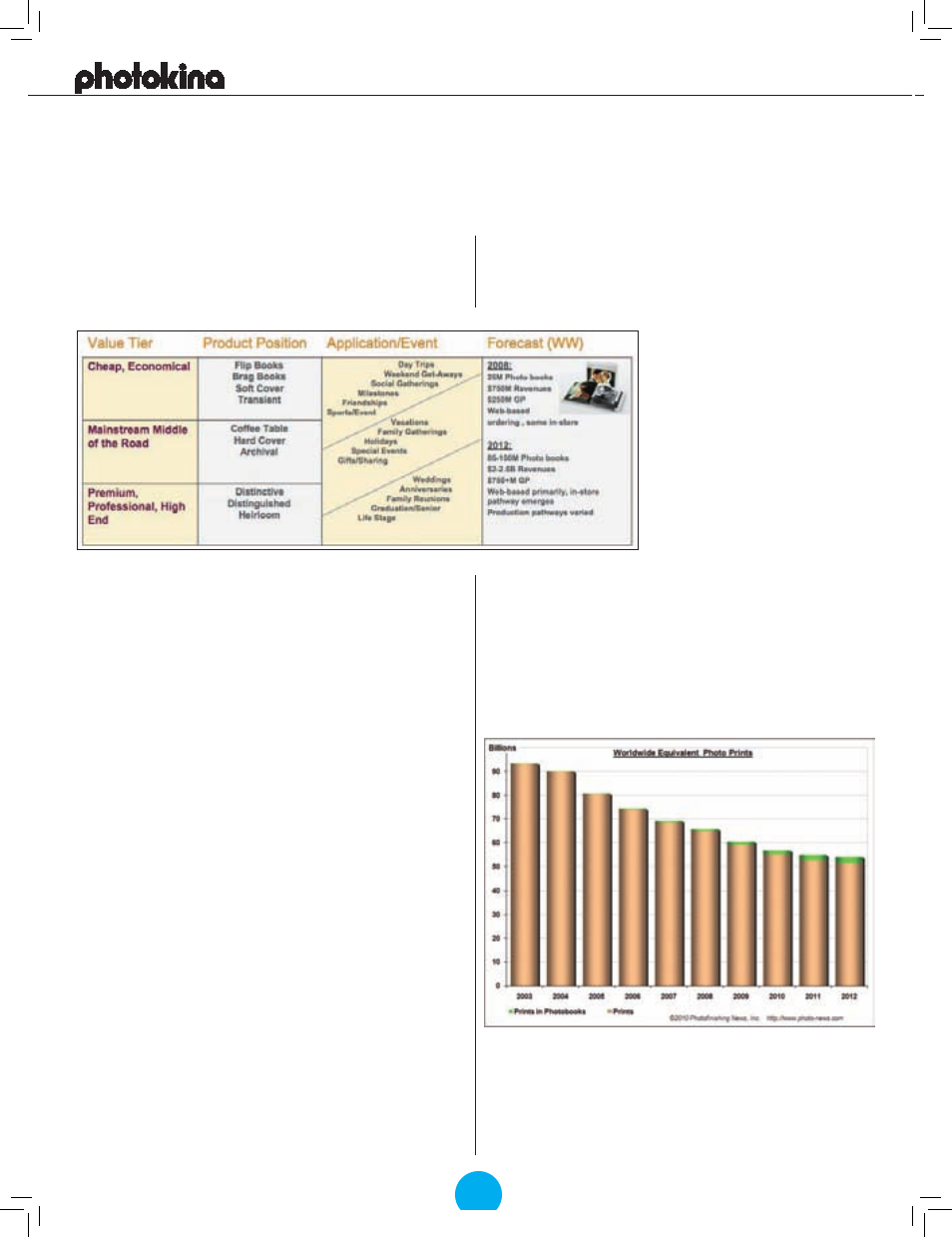

n the photo-imaging industry we all talk about photobooks and

assume everyone is referring to the same product. But are they? At

the 2009 International Business Forum in China, Kodak presented an

interesting chart depicting the wide range of photobook opportunities

available across different price points.

events, such as weddings. One reason that the average photobook price

has remained relatively steady has been the introduction of minibooks,

which measure 5x5cm and can be carried in ladies’ purses. Japanese

consumers are very cost-conscious, with consumers picking up 95 per

cent of their Kitamura photobook orders at a retail location to avoid

paying shipping charges.

Acknowledging that significant

barriers still exist to more widespread

photobook creation, such as the time

and effort needed for the design as well

as the select and upload procedures,

Ohnishi said Kitamura is offering a

photobook design service, initially for

wedding books only. In a reversal of the

actions preceding the introduction of

APS films, he is advocating that camera

manufacturers save the DPOF data, which

is used by photofinishers, as metadata

with each image to simplify production.

On behalf of Kitamura, which is a major

retailer of cameras, he invited 16 camera

manufacturers to participate in discussions about how they can help grow

the photobook business. At the time of the conference in June, he said

that several companies had agreed to this proposal.

If we consider the prints that now are contained within photobooks

as part of the overall photo printing business, the decline in worldwide

photo printing is bottoming out, as shown below. After 2012, we expect

that the “equivalent prints” figure may begin to climb again. Those

readers who have studied our earlier forecasts will notice that we have

tempered our optimism as we witness the relatively slow development

of this exciting market segment.

Each of these categories will have its features: from pages produced

by printer on silver halide photo, inkjet or dye sub media to those made

on digital presses; from soft- to hard- to leather-bound coves; from

single-page arrangements to double-page “lay-flat” designs; and from

simple to creative photo/text layouts. The choice will be based in part

on what moments are being captured and what story is being told. From

fairly frequent life events to those once-in-a-lifetime events.

The channels through which consumers can obtain these products are

evolving as well – from mostly on-line ordering to in-store software that

encourages them to quickly to tell their story and express their creativity

while enabling retailer service providers to expand their portfolio to

meet these different needs with options for making them in-house.

Photobooks represent high-value-added products and, as a result, this

growing market segment is attracting new competitors. Established

commercial bookmakers, who have watched their profit margins shrink

during the world’s economic woes over the past two years, are longingly

viewing this opportunity to utilise their equipment and skills to boost

their returns.

In Japan, for instance, Akihiko Ogino, President of Contents Works,

recently told a conference organised by the Photobook Promotion

Association that his on-demand publishing company started offering

photo albums in 2004, and two years ago entered the on-demand

photobook market, adding large-format sizes last year. He commented

that customers for his pocket-size books, buy an average of 2.6 books/

order and 30 per cent order additional books within 12 months. Half of

those orders are for gifts.

During this same conference, Hideyuki Ohnishi, Director of central

lab operations at Labo Network, a division of Kitamura, Japan’s largest

specialty store chain with more than 1,000 outlets, spoke about the

growth of the domestic photobook market from 950,000 units in 2007

to 2.05 million in 2008 and 3.05 million in 2009. The corresponding

retail value was ¥1.9 Billion, ¥4.0 Billion and ¥6.4 Billion, respectively,

putting the average price at around ¥2,000 for each of the three years.

He also categorised the market, saying that those photobooks below

¥2,100 are “content books” to commemorate cultural events involving

babies and children and have soft covers, while those photobooks over

¥3,000 have hard covers because they contain memories of special

Why? Besides the consumer awareness and photobook creation

issues already mentioned, additional challenges for traditional

photofinishers entering this market segment are: 1. Learning how to

make books and, for those buying digital presses, how to print in CMYK

rather than RGB and; 2. Developing the necessary marketing skills to

reach the “new” consumers who thrive on social networks. Commercial

printers and bookmakers eyeing this lucrative market segment, who

already possess the skills to make high quality photobooks, also lack