Persistence of price (pop) – EdgeWare FastBreak Standard Version 6.2 User Manual

Page 88

88

looking at three days of closing prices. For example, today’s true range would be the

high of the last three days minus the low of the last three days.

The ATR and SD of the true ranges is calculated over a user defined number of market

days. Kase has recommended 30 market days, but the user can specify any number of

market days.

Kase typically uses three standard deviations (#SD) for her work, but this is probably too

few for mutual funds because of the low volatile nature of most mutual funds, and the

three day calculation of true range probably introduces additional smoothing. We rec-

ommend trying values of 4 to 7.

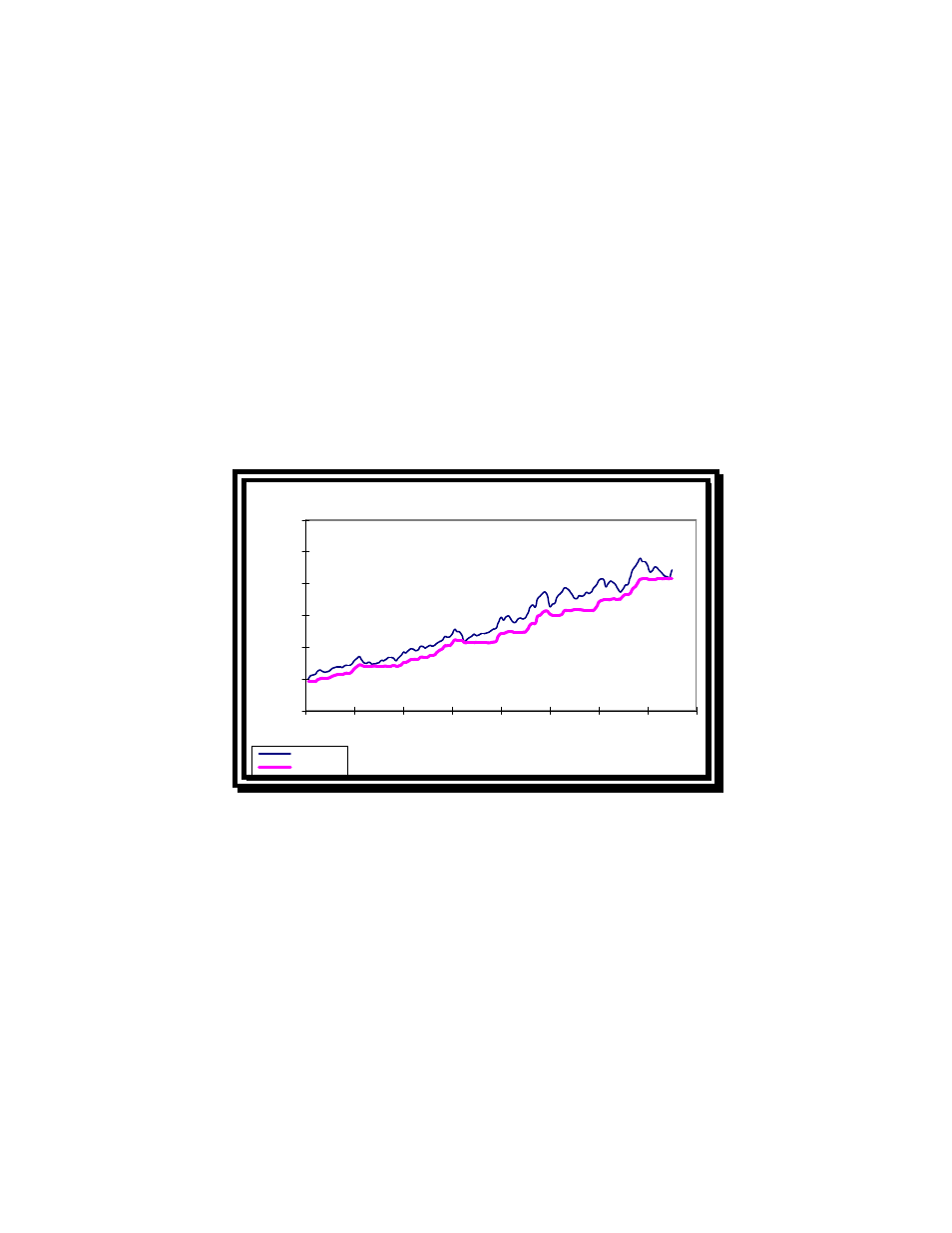

Graphically, the mutual fund NAV and corresponding Dev-Stop value look as follows

once a trade is initiated:

Kase Dev-Stop

20

25

30

35

40

45

50

0

20

40

60

80

100

120

140

160

Trade Days

N

A

V

,

$

NAV

Dev-Stop

Persistence of Price (POP)

If a user does not understand all aspects of the calculations used in POP, here is the im-

portant rule - Increasing the user input value for POP will tend to favor funds that have

small drawdowns over the ranking periods. The net effect should be to lower the Ulcer

Index of a strategy; however, you may decrease the annualized return for the strategy.

This is a tradeoff that only the user can make.

This concept is unique to FastBreak and was inspired by Marc Chaikin’s Persistency of

Money Flow. One aspect of Chaikin’s concept is that stocks which are in demand by in-

vestors will draw buyers each time the stock has a small pull back and the pull back never