Appendix a - technical discussion, Curve fitting – EdgeWare FastBreak Standard Version 6.2 User Manual

Page 84

84

Appendix A - Technical Discussion

Curve Fitting

FastBreak uses three different types of curve fits: Least Squares Linear, Power (called

non-linear on menu), and Quadratic.

Linear is the most common curve fit and has the form: y = a

1

x + a

0

Where:

x : is the independent variable (in our case, days)

y : is the dependent variable (in our case the normalized NAV)

a : is a constant

The slope is the rate of change of y with respect to x. For this equation the slope is a

1

(a

constant value)

The Quadratic equation has the form: y = a

2

x

2

+a

1

x + a

0

The slope is: 2 a

2

x+ a

1

(slope varies with x)

The Power equation has the form: y = a x

b

b : is a constant

The slope is: abx

b-1

Again, the slope varies with x

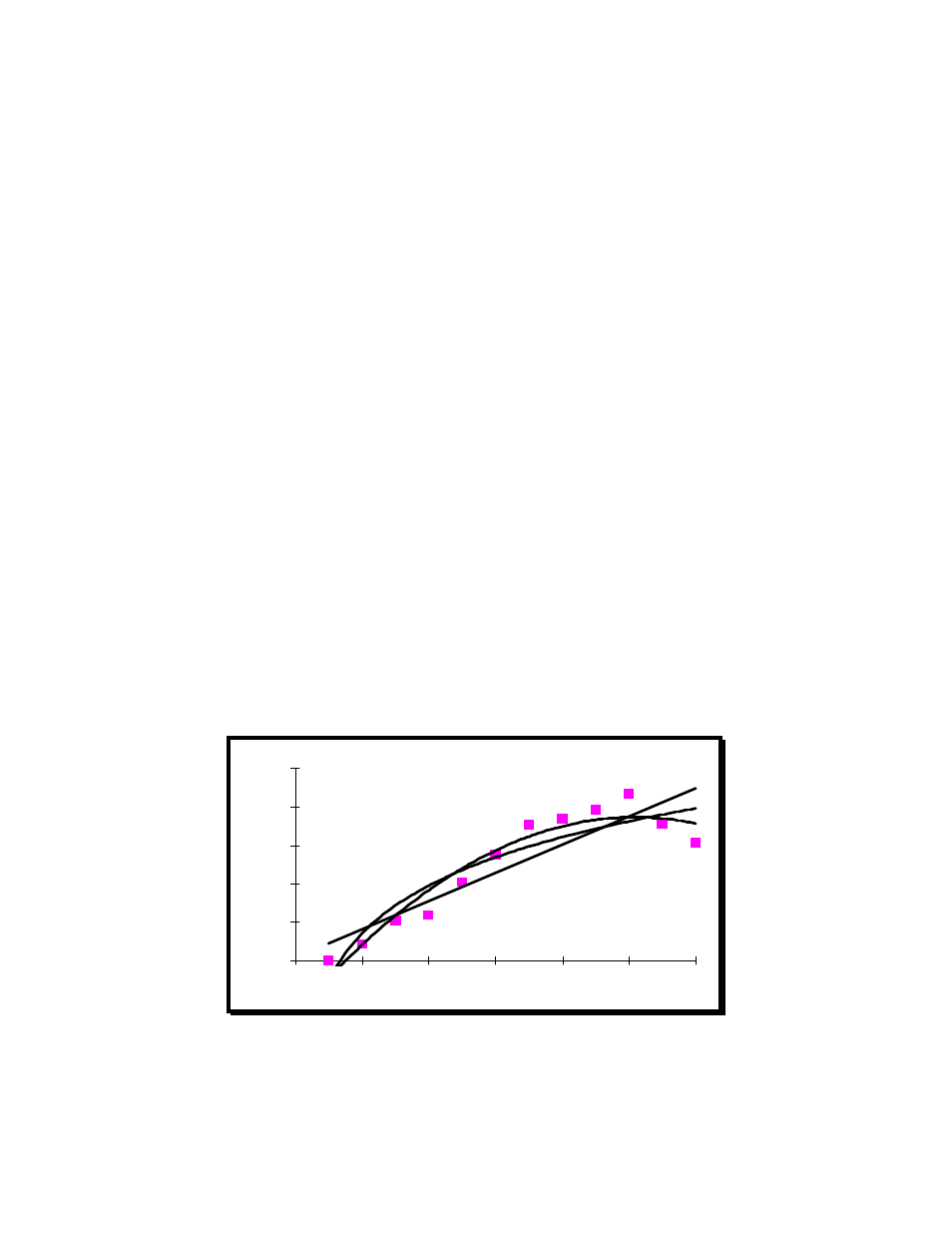

How do these equations look when plotted?

Normalized Price Data

y = 0.0037x + 1.0009

y = 0.9947x

0.0178

y = -0.0005x

2

+ 0.0101x + 0.9858

1.00

1.01

1.02

1.03

1.04

1.05

0

2

4

6

8

10

12

T rading Days

N

A

V

Each equation has a somewhat different fit to the data. The NAV is normalized in Fast-

Break by dividing the NAV of each trading day by the NAV of the first trading day at the

start of the ranking period.