Vat invoices (invoices_vat), Configuring fiscal area and localization, Td extraction – Kofax TotalAgility AP Automation User Manual

Page 33: Td formatting

Configuration

Kofax TotalAgility AP Automation Kofax TotalAgility AP Automation Guide

33

VAT Invoices (Invoices_VAT)

Invoices for VAT regions can be scanned using the VAT Scan Create New Job form. A capture

project has been delivered to extract VAT UK invoices. The VAT folder process will create the

standard AP processes for each invoice.

Configuring Fiscal Area and Localization

TD Extraction

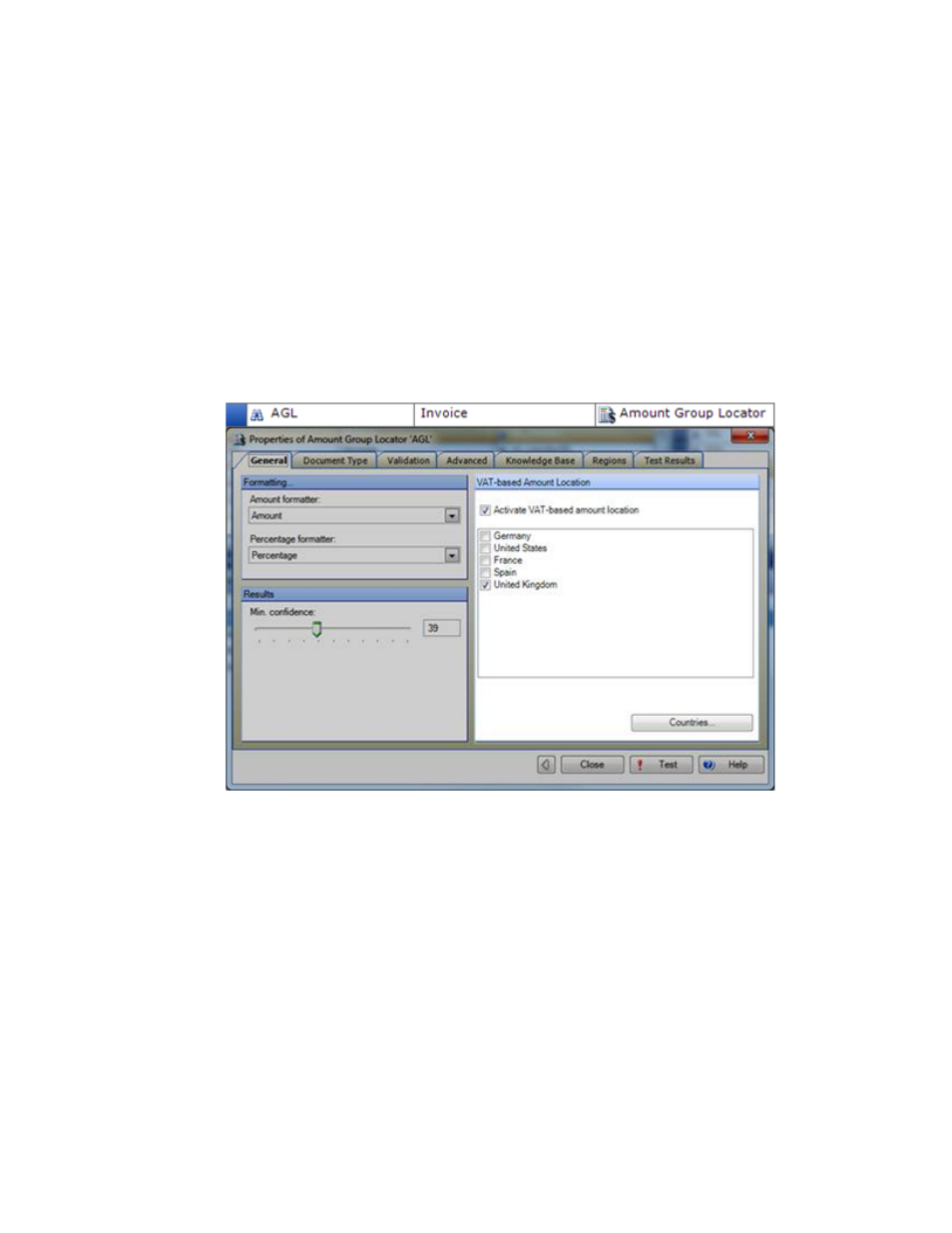

1 In Transformation Designer, open the Amount Group Locator (AGL).

2 Select the correct fiscal area for the AGL. See the following figure.

TD Formatting

KTM can make use of the system default decimal comma or decimal point, or you can specify

the decimal comma or decimal point. The UK uses a decimal point, whereas DE, FR, ES and

FR use a decimal comma.

The project has been configured for UK invoice documents and in the UK, the amounts are

formatted with a decimal point. The following formatting methods need to be altered if you

wish to demonstrate either the French, German or Spanish fiscal areas, where the amounts

have a decimal comma:

▪ LineItemQuantity

▪ LineItemAmount

▪ Percentage

▪ Amount