The opportunity in last-mile copper, Efm technology, Efm in context – Zhone Technologies ZTI-PG User Manual

Page 5

A C C E S S F O R A C O N V E R G I N G W O R L D

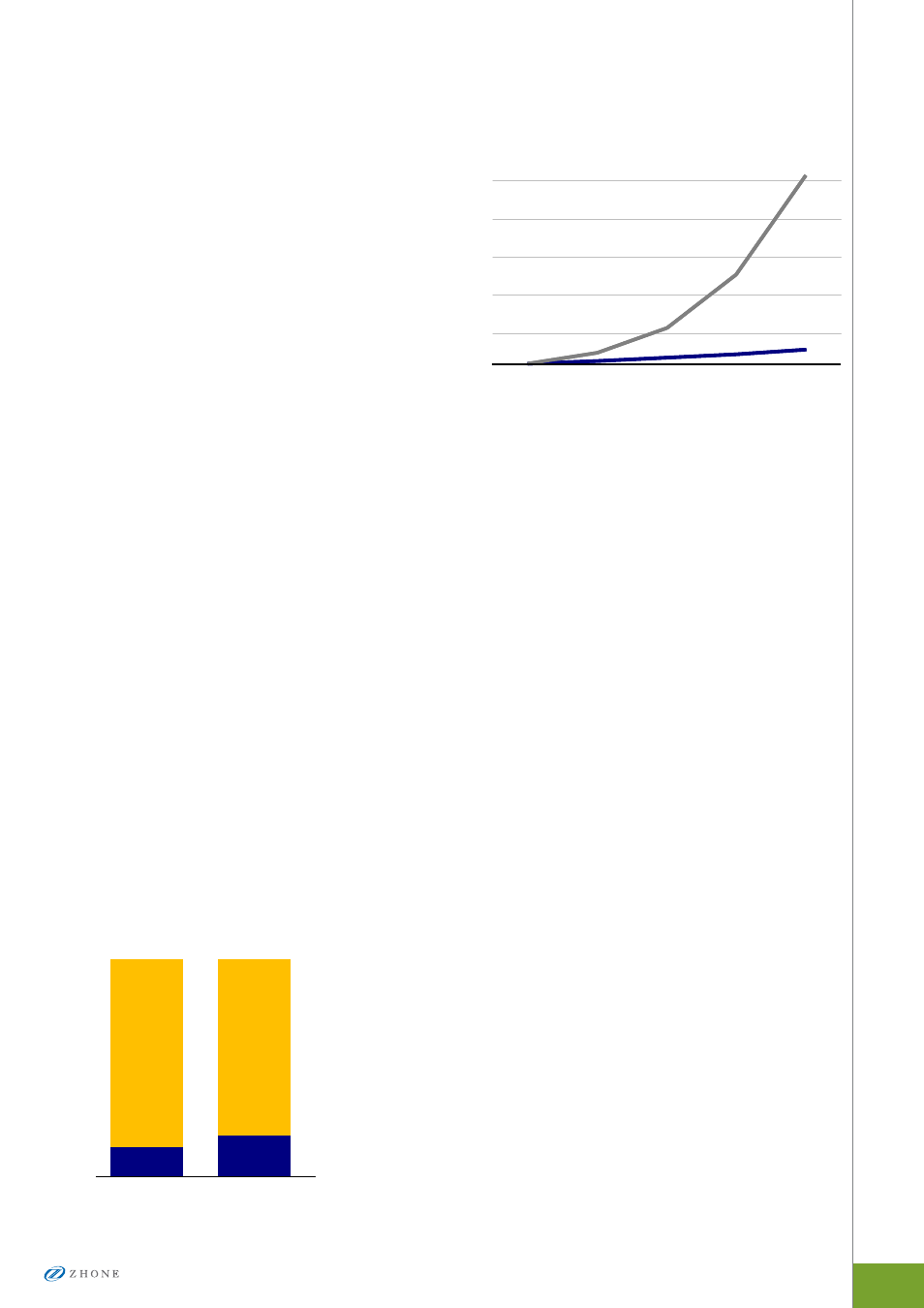

Forecasts aggregated from across the telecommunications

industry highlight clearly the magnitude of these changes

in non-residential wireline and cellular data traffic —

with 32% and an astounding 125% compound annual

growth rates, respectively. Given the relatively slow

growth in the population of SMOs and cell sites, the

traffic per location looks set to continue rising substan-

tially.

The Opportunity in Last-Mile

Copper

While the telecom industry’s response to demand for

higher bandwidth is generally to push fiber closer to the

customer premise, for SMOs and many cell sites, there

are complications with that approach. While the forecast

traffic growth rate in these segments is substantial, it’s

starting from a very small base — typically something on

the order of a 1.5 Mbps T1 or 2.0 Mbps E1 data service

line. For these smaller sites, it will take years of steady

traffic growth to reach the point where service demand

and willingness to pay will justify the high costs of

running fiber to these premises. Unlike residential

neighborhoods where the cost of fiber deployment can be

more easily amortized over a number of subscribers, the

lower teledensity of SMOs and cell sites means the fiber

deployment business case for an individual location must

bear the full installation costs largely alone. Given these

realities, the slow rate of growth in fiber penetration to

businesses is unsurprising. One industry analyst, Vertical

500

1,000

1,500

2,000

2,500

2009

2010

2011

2012

2013

Non-Residential

Wireline

(32% CAGR)

Cellular Data

(125% CAGR)

100

IP Traffic Forecast

(Normalized to 2009 = 100)

500

1,000

1,500

2,000

2,500

2009

Source: Cisco VNI 2009

2010

2011

2012

2013

Non-Residential

Wireline

(32% CAGR)

Cellular Data

(125% CAGR)

100

IP Traffic Forecast

(Normalized to 2009 = 100)

100%

Fiber

Copper

Last-Mile Fiber Penetration in SMO market.

2006

2008

Source: Vertical Systems Group

Systems Group, reported in 2006 that only 13.4% of

businesses in the US were served by fiber. Two years later

their 2008 survey found just 19.1% penetration of fiber

connections in the business segment. The business case

for fiber deployment to these segments is obviously

improving, but at a modest rate that will leave the large

majority of these customers limited to copper-based

solutions for some time.

EFM Technology

Fortunately there is an excellent solution for these copper-

bound SMO and cell site applications in the form of

Ethernet over Copper, and in particular the industry-

standard Ethernet in the First Mile technology (common-

ly referred to as EFM).

EFM in Context

To clarify terminology, it’s helpful to look at EFM in the

general context of the growing adoption of Ethernet.

Since Ethernet is taking different forms in access, distribu-

tion, and core networks, the jargon can be confusing.

The table on the next page provides a summary snapshot

of the various Ethernet technologies in use today outside

the LAN environment. The overlap between the applica-

tion groupings (the horizontal axis) is the primary source

of confusion. The IEEE 802.3ah standard, the more

formal name for EFM, actually covers both fiber and

copper technologies. In practice, though, the term

“Active Ethernet” is used for 802.3ah standards over

point-to-point fiber, leaving EFM as the working term for

802.3ah over copper. The higher-speed Metro Ethernet