CITIZEN CT-555N User Manual

Page 36

- 7 -

07

REP

[

CHECK

][

CHECK

][

CHECK

]

[

CHECK

]

M

40.

00

All clear & return to

initial status

[

MRC] [MRC] [ON/C]

0.

6. Price Mark-Up & Down Calculation / Calculación del Aumento &

Rebasamiento del precio / Cálculo da marcagem e quitamento do preço /

Preis Mark-Up & Down Rechnung / Marge De BÉNÉFICE Brut / Calcolo del

Ricarico e del Ribasso dei Prezzi / Berekening van afgeprijsde &

verhoogde prijzen / Pris Avance & Rabat Beregning /

ȼɵɱɢɫɥɟɧɢɟ

ɩɪɢɪɨɫɬɚ / ɫɧɢɠɟɧɢɹ ɰɟɧɵ / Ustalanie przyrostu / obniĪki ceny/

Ϟϔγ ϰϟ Αήϟ

/

ήόγ ϕϮϓ ϰϟ

. / Penghitungan harga tanda atas dan bawah /

ᤳ

Ⲟ䖤ㅫ / ȊʌȠȜȠȖȚıȝȩȢ ĮȪȟȘıȘȢ & ȝİȓȦıȘȢ IJȚȝȒȢ

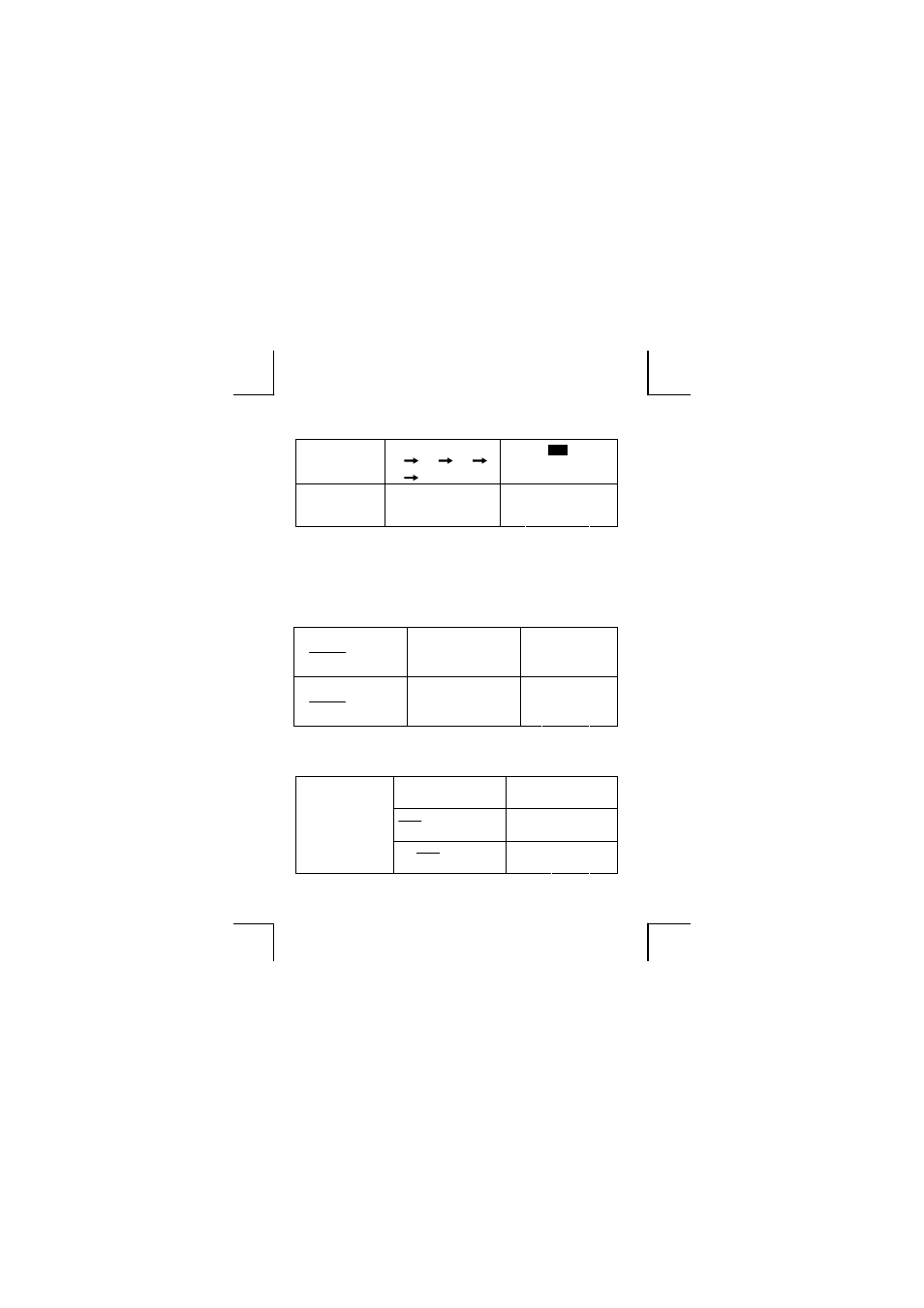

01

20.

MU

03

25.

%

20+(Px20%)=P

P=

%

20

1

20

=25

20 [

MU]

20 [%]

[=]

04

5.

=

01

125.

MU

03

100.

%

125–(Px25%)=P

P=

%

25

1

125

=100

125 [

MU]

25 [

M

][

MRC] [%]

[=]

04

-25.

=

7.Tax Calculation / Cálculo de impuestos / Cálculo de Imposto /

Steuerberechnung / Calcul de l’impôt / Calcolo dell’imposta / Berekening

van belastingen / Afgiftsberegning /

ȼɵɱɢɫɥɟɧɢɟ ɧɚɥɨɝɨɜ / Obliczenie

podatku /

ΔΒϳήπϟ ΏΎδΣ / Perhitungan Pajak / ⥛䅵ㅫ/ YʌȠȜȠȖȚıȝȩȢ ijȩȡȠȣ

01 RATE

3 [RATE]

3.

01

TAX

%

[

SET

TAX

]

3.

01

+TAX

150+TAX(3%)

=154.5

Tax sum = 4.5

Tax inclusive value

= 154.5

150 [

SET

TAX

]

154.5