EdgeWare FastBreak Pro Version 6.2 User Manual

Page 26

26

would result in only one day to calculate the curve fit. The curve fit equations require

up to three days to make the calculation, and FastBreak Pro will set the adjusted buy

ranking period to three days.

Note: If you use this option, the maximum adjustment factor can impact the IS start

date. For example, if you input a maximum Ranking value of 90 days and a maximum

adjustment factor of 2, then the IS start date will need to allow 180 days of data for the

initial ranking.

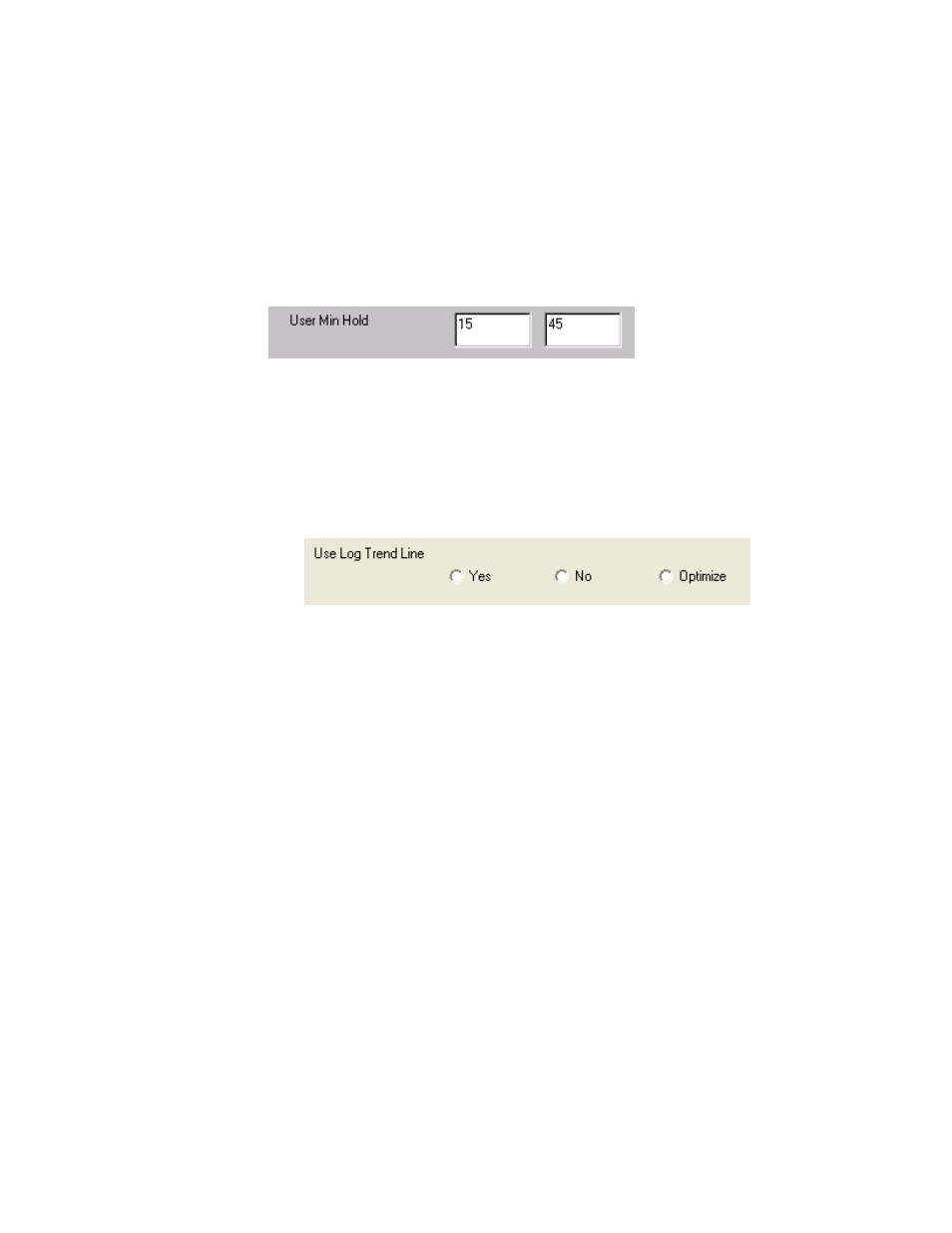

User Min Hold

It is recommended that when setting the User Min Hold maximum range value to span

“monthly” periods of time, i.e., 35, 65, 95 days. In other words, when setting the

maximum value it is better to choose 35 days rather than 28 days, or 65 days rather than

59 days. This is especially true for bond trading systems because bonds make monthly

distributions and it is important to capture the effects of these distributions. The values

are calendar days.

Use Log Trend Line

The FastBreak Pro optimizer can be used to optimize the nature of trendlines. It can also

be used to determine whether Linear or Logarithmic trendlines are best.

If the Yes option is chosen then only logarithmic trendlines will be used. This option

controls both the Stop and Buy Filter trendlines.

In other words, you can’t mix

logarithmic and linear trendline options for Buy filters and sell Stops. If the No radio

button is chosen then only linear trendlines will be used.

If the Optimize option is selected then the optimizer will try both logarithmic and linear

trendlines to determine which works best.